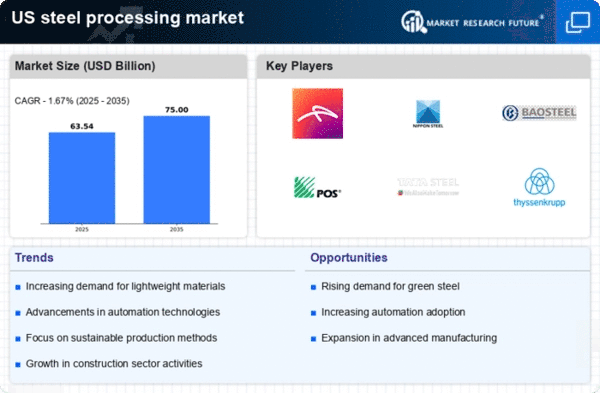

The steel processing market is currently characterized by a dynamic competitive landscape, driven by factors such as technological advancements, sustainability initiatives, and strategic mergers and acquisitions. Major players like United States Steel Corporation (US), ArcelorMittal (LU), and Nippon Steel Corporation (JP) are actively shaping the market through their innovative approaches and operational focuses. United States Steel Corporation (US) has been emphasizing digital transformation and sustainability, aiming to reduce its carbon footprint significantly. In contrast, ArcelorMittal (LU) is focusing on expanding its product portfolio to include more high-strength steel solutions, which are increasingly in demand across various industries. Nippon Steel Corporation (JP) is also investing heavily in research and development to enhance its production efficiency and product quality, thereby reinforcing its competitive positioning.The business tactics employed by these companies reflect a trend towards localizing manufacturing and optimizing supply chains to enhance responsiveness to market demands. The market structure appears moderately fragmented, with several key players exerting considerable influence. This fragmentation allows for a diverse range of products and services, catering to various customer needs while fostering healthy competition among the major players.

In October United States Steel Corporation (US) announced a strategic partnership with a leading technology firm to develop advanced AI-driven solutions for its manufacturing processes. This move is likely to enhance operational efficiency and reduce production costs, positioning the company favorably in a competitive market increasingly focused on technological integration. The partnership underscores the importance of innovation in maintaining a competitive edge.

In September ArcelorMittal (LU) launched a new line of eco-friendly steel products aimed at the automotive sector, which is undergoing a significant transformation towards sustainability. This initiative not only aligns with global environmental goals but also caters to the growing demand for sustainable materials in manufacturing. The introduction of these products may enhance ArcelorMittal's market share and strengthen its reputation as a leader in sustainable steel production.

In August Nippon Steel Corporation (JP) completed the acquisition of a regional steel processing facility, which is expected to bolster its production capacity and market reach in North America. This acquisition reflects a strategic move to enhance operational capabilities and respond to the increasing demand for steel in various sectors, including construction and automotive. The integration of this facility may provide Nippon Steel with a competitive advantage in terms of supply chain efficiency and customer service.

As of November the competitive trends in the steel processing market are increasingly defined by digitalization, sustainability, and the integration of advanced technologies such as AI. Strategic alliances are becoming more prevalent, as companies recognize the need to collaborate to enhance innovation and operational efficiency. The shift from price-based competition to a focus on technological advancement and supply chain reliability is evident, suggesting that future competitive differentiation will hinge on the ability to innovate and adapt to changing market dynamics.