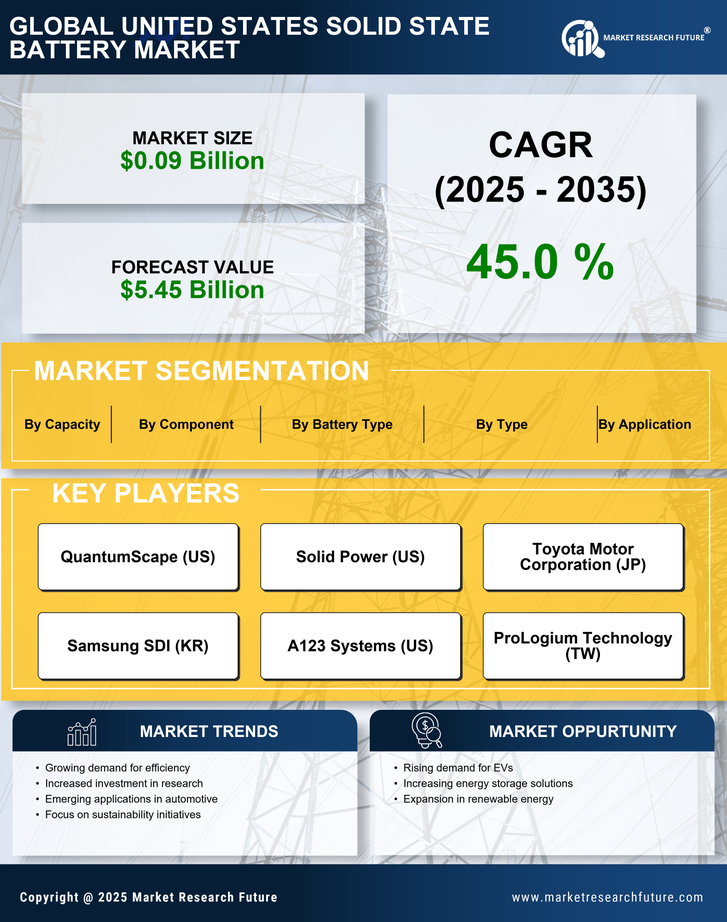

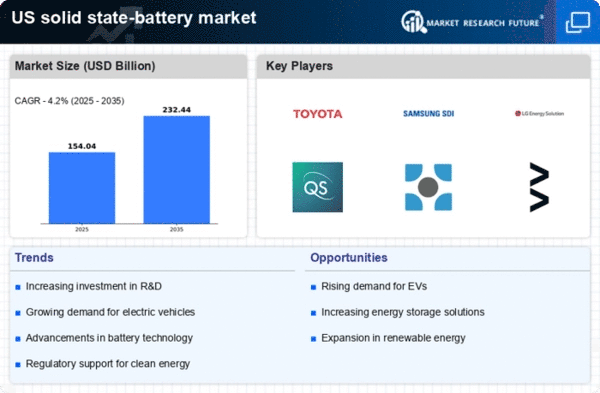

The solid state-battery market is currently characterized by intense competition and rapid innovation, driven by the increasing demand for high-performance energy storage solutions across various sectors, particularly in electric vehicles (EVs) and consumer electronics. Major players such as QuantumScape (US), Solid Power (US), and Toyota (JP) are at the forefront, each adopting distinct strategies to enhance their market positioning. QuantumScape (US) focuses on advancing its proprietary solid-state technology, aiming to achieve higher energy densities and faster charging times, which could potentially revolutionize the EV market. Meanwhile, Solid Power (US) emphasizes partnerships with automotive manufacturers to facilitate the integration of its solid-state batteries into commercial vehicles, thereby enhancing its operational focus on scalability and production efficiency. Toyota (JP), leveraging its extensive experience in battery technology, is investing heavily in R&D to develop next-generation solid-state batteries, indicating a commitment to maintaining its leadership in the automotive sector.

In terms of business tactics, companies are increasingly localizing manufacturing to mitigate supply chain disruptions and optimize logistics. This trend is particularly evident in the solid state-battery market, which appears to be moderately fragmented, with several key players vying for market share. The collective influence of these companies is shaping a competitive structure that encourages innovation and collaboration, as firms seek to differentiate themselves through technological advancements and strategic partnerships.

In October 2025, QuantumScape (US) announced a groundbreaking partnership with a leading automotive manufacturer to co-develop a new line of solid-state batteries tailored for high-performance electric vehicles. This collaboration is expected to accelerate the commercialization of QuantumScape's technology, potentially positioning the company as a key supplier in the rapidly evolving EV market. The strategic importance of this partnership lies in its potential to enhance QuantumScape's production capabilities while simultaneously providing the automotive partner with a competitive edge in battery performance.

In September 2025, Solid Power (US) secured a significant investment from a consortium of automotive companies, aimed at scaling up its production facilities for solid-state batteries. This funding is crucial for Solid Power as it seeks to meet the growing demand for its products, particularly in the EV sector. The investment not only strengthens Solid Power's financial position but also underscores the confidence that major automotive players have in its technology, which could lead to increased market penetration and brand recognition.

In November 2025, Toyota (JP) unveiled its latest solid-state battery prototype, which reportedly offers a 30% increase in energy density compared to its previous models. This announcement is pivotal as it reinforces Toyota's commitment to innovation and positions the company to potentially lead the market in battery technology advancements. The implications of this development are profound, as it may set new benchmarks for performance in the automotive industry, compelling competitors to accelerate their own R&D efforts.

As of November 2025, the competitive landscape is increasingly defined by trends such as digitalization, sustainability, and the integration of artificial intelligence in battery management systems. Strategic alliances are becoming more prevalent, as companies recognize the need to collaborate to enhance their technological capabilities and market reach. Looking ahead, it is likely that competitive differentiation will evolve from traditional price-based strategies to a focus on innovation, technological superiority, and supply chain reliability, as firms strive to meet the demands of a rapidly changing market.