Rising Demand for Wearable Devices

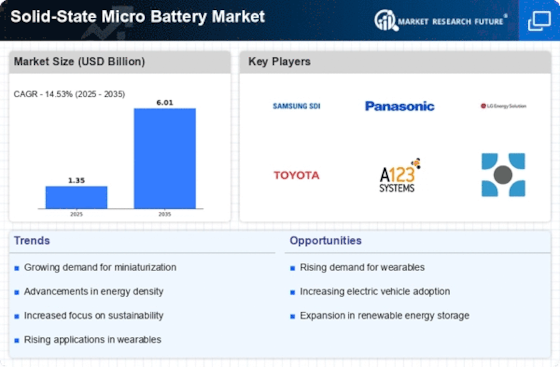

The Solid-State Micro Battery Market is poised to benefit from the rising demand for wearable devices, which require compact and efficient power sources. The global market for wearable technology is projected to reach USD 100 billion by 2025, with a significant portion of this growth attributed to health monitoring devices, smartwatches, and fitness trackers. These devices necessitate batteries that are not only small but also capable of delivering reliable performance over extended periods. Solid-state micro batteries, with their superior energy density and safety features, are well-suited to meet these requirements. As manufacturers increasingly prioritize miniaturization and efficiency, the adoption of solid-state micro batteries in wearables is expected to accelerate, thereby propelling the Solid-State Micro Battery Market forward.

Advancements in Consumer Electronics

The Solid-State Micro Battery Market is significantly influenced by advancements in consumer electronics, where the demand for high-performance batteries is ever-increasing. With the proliferation of smartphones, tablets, and other portable devices, manufacturers are seeking batteries that can provide longer usage times without compromising on size. Solid-state micro batteries, known for their compact design and high energy density, are becoming increasingly popular in this sector. The consumer electronics market is projected to grow at a CAGR of approximately 5% over the next few years, further driving the need for innovative battery solutions. As companies strive to enhance user experience through longer battery life and faster charging capabilities, the adoption of solid-state micro batteries is expected to rise, thereby bolstering the Solid-State Micro Battery Market.

Increased Focus on Electric Vehicles

The Solid-State Micro Battery Market is likely to see substantial growth due to the increased focus on electric vehicles (EVs). As governments and consumers alike push for greener alternatives to fossil fuel-powered transportation, the demand for efficient and high-performance batteries is escalating. Solid-state batteries offer advantages such as faster charging times and longer lifespans, making them an attractive option for EV manufacturers. The market for electric vehicles is anticipated to grow at a compound annual growth rate (CAGR) of over 20% through the next decade. This growth is expected to drive investments in solid-state battery technology, as automakers seek to enhance the performance and safety of their electric vehicles. Consequently, the Solid-State Micro Battery Market stands to gain from this trend, as manufacturers align their products with the evolving needs of the automotive sector.

Technological Innovations in Energy Storage

The Solid-State Micro Battery Market is experiencing a surge in technological innovations that enhance energy storage capabilities. Recent advancements in solid-state technology have led to batteries that offer higher energy densities and improved safety profiles compared to traditional lithium-ion batteries. For instance, the energy density of solid-state batteries can reach up to 500 Wh/L, which is significantly higher than conventional batteries. This increase in energy density is crucial for applications in portable electronics and electric vehicles, where space and weight are critical factors. Furthermore, the development of new materials, such as solid electrolytes, is paving the way for batteries that can operate at higher temperatures and exhibit longer life cycles. As these technologies mature, they are likely to drive the growth of the Solid-State Micro Battery Market, attracting investments and fostering competition among manufacturers.

Regulatory Support for Clean Energy Solutions

The Solid-State Micro Battery Market is benefiting from regulatory support aimed at promoting clean energy solutions. Governments worldwide are implementing policies and incentives to encourage the development and adoption of sustainable energy technologies, including advanced battery systems. This regulatory environment is fostering innovation and investment in solid-state battery technologies, which are seen as a key component in the transition to renewable energy sources. For example, initiatives aimed at reducing carbon emissions are likely to increase the demand for solid-state batteries in various applications, from grid storage to electric vehicles. As these regulations become more stringent, the Solid-State Micro Battery Market is expected to expand, driven by the need for cleaner, more efficient energy storage solutions.