Government Incentives and Policies

Government incentives and policies are pivotal in driving the Electric Vehicle Solid State Battery Market. Many countries are implementing favorable regulations and financial incentives to promote the adoption of electric vehicles. For instance, tax credits, rebates, and grants for EV purchases are becoming increasingly common, encouraging consumers to transition from internal combustion engines to electric alternatives. Additionally, governments are setting ambitious targets for reducing carbon emissions, which further stimulates the demand for electric vehicles and their associated technologies. As a result, the Electric Vehicle Solid State Battery Market is likely to benefit from these supportive measures, fostering a conducive environment for growth and innovation.

Rising Demand for Electric Vehicles

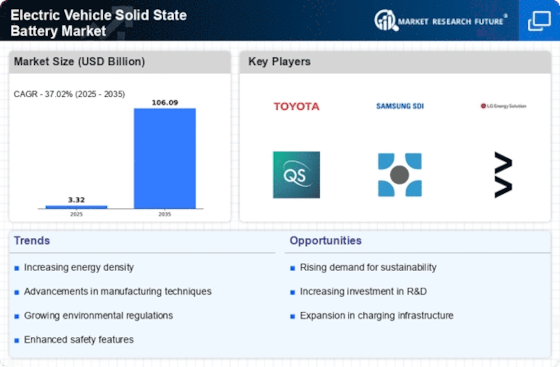

The increasing consumer preference for electric vehicles (EVs) is a primary driver for the Electric Vehicle Solid State Battery Market. As more individuals seek sustainable transportation options, the demand for efficient and high-performance batteries rises. In 2025, the EV market is projected to reach approximately 30 million units sold, indicating a robust growth trajectory. This surge in demand necessitates advancements in battery technology, particularly solid-state batteries, which offer higher energy density and improved safety compared to traditional lithium-ion batteries. Consequently, manufacturers are investing heavily in research and development to meet this growing demand, thereby propelling the Electric Vehicle Solid State Battery Market forward.

Competitive Landscape and Market Dynamics

The competitive landscape within the Electric Vehicle Solid State Battery Market is evolving rapidly, driven by the entry of new players and the strategic maneuvers of established companies. As the demand for electric vehicles escalates, numerous manufacturers are vying for market share, leading to increased innovation and collaboration. Partnerships between automotive manufacturers and battery producers are becoming more common, facilitating the development of cutting-edge solid-state battery technologies. This dynamic environment is likely to result in a more diverse range of products and solutions, catering to various consumer needs. By 2028, the competitive intensity in the Electric Vehicle Solid State Battery Market could lead to significant advancements in battery performance and affordability.

Environmental Concerns and Sustainability

Environmental concerns are increasingly influencing consumer choices and corporate strategies, thereby impacting the Electric Vehicle Solid State Battery Market. As awareness of climate change and pollution rises, there is a growing emphasis on sustainable practices within the automotive sector. Solid-state batteries, known for their lower environmental impact and potential for recyclability, align well with these sustainability goals. The shift towards greener technologies is expected to drive investments in solid-state battery research and production. By 2027, the market for sustainable battery solutions could witness a compound annual growth rate of over 20%, underscoring the importance of environmental considerations in shaping the Electric Vehicle Solid State Battery Market.

Technological Innovations in Battery Design

Technological innovations play a crucial role in shaping the Electric Vehicle Solid State Battery Market. Recent advancements in materials science and engineering have led to the development of solid-state batteries that promise enhanced performance metrics. These innovations include the use of solid electrolytes, which can potentially increase energy density by up to 50% compared to conventional batteries. As manufacturers strive to improve battery longevity and reduce charging times, the market for solid-state batteries is expected to expand significantly. By 2026, the market for solid-state batteries in electric vehicles could reach a valuation of over 10 billion USD, reflecting the impact of these technological advancements on the Electric Vehicle Solid State Battery Market.