Increasing Regulatory Pressures

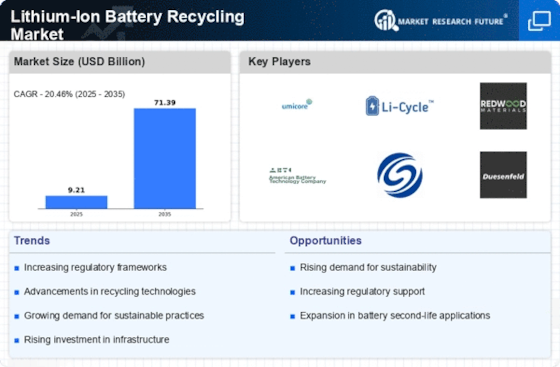

The Lithium-Ion Battery Recycling Market is significantly influenced by stringent regulatory frameworks aimed at promoting sustainable waste management. Governments are implementing policies that mandate the recycling of lithium-ion batteries to mitigate environmental hazards associated with improper disposal. For example, regulations in various regions require manufacturers to take responsibility for the end-of-life management of their products. This has led to an increase in recycling initiatives and partnerships between manufacturers and recycling firms. The market is projected to grow as compliance with these regulations becomes essential for companies operating in the battery supply chain. The anticipated rise in regulatory pressures is likely to create a more structured environment for the Lithium-Ion Battery Recycling Market, fostering innovation and investment.

Expansion of Electric Vehicle Market

The Lithium-Ion Battery Recycling Market is closely linked to the expansion of the electric vehicle (EV) market. As the demand for EVs continues to rise, so does the need for effective recycling solutions for lithium-ion batteries. The EV market is projected to grow exponentially, with estimates suggesting that by 2030, electric vehicles could account for a significant portion of new car sales. This growth presents a unique opportunity for the recycling industry, as the volume of spent batteries will increase correspondingly. Consequently, the Lithium-Ion Battery Recycling Market is likely to benefit from this trend, as automakers and battery manufacturers seek sustainable solutions for battery disposal and recycling, ensuring a circular economy.

Investment in Circular Economy Initiatives

The Lithium-Ion Battery Recycling Market is poised for growth due to increasing investments in circular economy initiatives. Companies are recognizing the economic potential of recycling lithium-ion batteries, which can recover valuable materials and reduce reliance on virgin resources. This shift towards a circular economy is supported by various stakeholders, including governments, private investors, and environmental organizations. Recent reports indicate that investments in battery recycling technologies are expected to rise significantly, driven by the need for sustainable resource management. As more entities commit to circular economy principles, the Lithium-Ion Battery Recycling Market is likely to see enhanced collaboration and innovation, ultimately leading to a more sustainable future.

Technological Innovations in Recycling Methods

The Lithium-Ion Battery Recycling Market is experiencing a surge in technological advancements that enhance recycling efficiency. Innovations such as hydrometallurgical and pyrometallurgical processes are being developed to recover valuable materials like lithium, cobalt, and nickel from spent batteries. These methods not only improve recovery rates but also reduce environmental impact. For instance, recent studies indicate that advanced recycling techniques can recover up to 95% of lithium from used batteries, which is a substantial increase compared to traditional methods. As technology continues to evolve, the industry is likely to see a shift towards more sustainable practices, making recycling more economically viable and environmentally friendly. This trend is expected to attract investments and drive growth in the Lithium-Ion Battery Recycling Market.

Rising Consumer Awareness and Demand for Sustainability

Consumer awareness regarding environmental issues is driving the Lithium-Ion Battery Recycling Market. As individuals become more conscious of their ecological footprint, there is a growing demand for sustainable products and practices. This shift in consumer behavior is prompting manufacturers to adopt recycling initiatives and promote the recyclability of their products. Market data suggests that consumers are increasingly willing to pay a premium for products that are environmentally friendly, which is influencing companies to invest in recycling technologies. The emphasis on sustainability is expected to bolster the growth of the Lithium-Ion Battery Recycling Market, as businesses align their strategies with consumer preferences for greener alternatives.