Advancements in Drone Technology

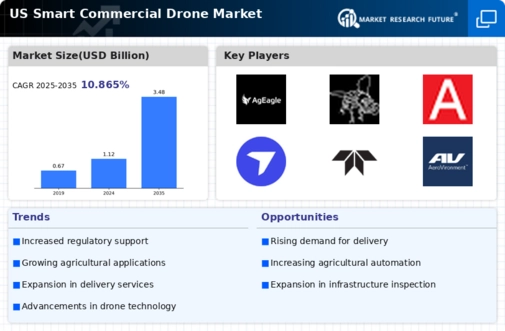

Technological innovations are a key driver of the smart commercial-drone market. Developments in artificial intelligence, machine learning, and sensor technology are enhancing drone capabilities, making them more efficient and reliable. For instance, drones equipped with advanced navigation systems can operate in complex environments, which is crucial for commercial applications. The market is expected to grow at a CAGR of around 15% from 2025 to 2030, driven by these advancements. Furthermore, improvements in battery life and payload capacity are enabling drones to undertake longer missions and carry heavier loads, expanding their utility across various sectors. This technological evolution is likely to attract more businesses to adopt smart commercial-drone solutions.

Increased Demand for Delivery Services

The rise in e-commerce and the need for efficient delivery solutions are driving the smart commercial-drone market. As consumers increasingly expect rapid delivery, businesses are exploring drone technology to meet these demands. In 2025, the market for drone delivery services is projected to reach approximately $10 billion in the US alone. This surge is attributed to the ability of drones to navigate urban environments quickly, reducing delivery times significantly. Companies are investing in smart commercial-drone technology to enhance their logistics capabilities, thereby improving customer satisfaction and operational efficiency. The integration of drones into supply chains is likely to become a standard practice, further propelling the growth of the smart commercial-drone market.

Increased Investment in Drone Startups

The influx of venture capital into drone startups is a notable driver of the smart commercial-drone market. Investors are recognizing the potential of drone technology across various industries, leading to substantial funding rounds for innovative companies. In 2025, investment in drone technology is anticipated to surpass $5 billion in the US, reflecting a growing confidence in the market's future. This financial support enables startups to develop cutting-edge solutions, enhancing the overall capabilities of the smart commercial-drone market. As these companies bring new technologies to market, they are likely to stimulate competition and drive further advancements in the industry.

Growing Interest in Agricultural Applications

The agricultural sector is increasingly recognizing the potential of drones, which is significantly impacting the smart commercial-drone market. Drones are being utilized for crop monitoring, precision agriculture, and livestock management, providing farmers with valuable data to enhance productivity. In 2025, the agricultural drone market is estimated to be worth over $3 billion in the US, reflecting a growing trend towards technology adoption in farming practices. By employing drones, farmers can optimize resource use, reduce costs, and improve yields. This trend suggests that the smart commercial-drone market will continue to expand as agricultural stakeholders seek innovative solutions to meet the challenges of modern farming.

Expansion of Infrastructure and Urban Planning

Urbanization and infrastructure development are driving the smart commercial-drone market as cities seek innovative solutions for planning and management. Drones are increasingly used for surveying, mapping, and monitoring urban environments, providing real-time data that aids in decision-making. The US urban drone market is projected to grow significantly, with investments in smart city initiatives likely to exceed $100 billion by 2025. This growth indicates a shift towards integrating drone technology into urban planning processes, enhancing efficiency and sustainability. As municipalities recognize the benefits of drones for infrastructure projects, the smart commercial-drone market is expected to flourish.