Rising Cybersecurity Threats

The US Secure Access Services Edge Market is increasingly influenced by the rising prevalence of cybersecurity threats. With cyberattacks becoming more sophisticated and frequent, organizations are compelled to adopt advanced security measures to protect sensitive data and maintain operational integrity. The market is projected to grow as businesses recognize the necessity of implementing secure access solutions that provide comprehensive protection against potential breaches. In 2025, it was estimated that cybercrime would cost the global economy over 10 trillion USD annually, underscoring the urgency for robust security frameworks. As a result, the US Secure Access Services Edge Market is likely to expand as organizations prioritize investments in security technologies that mitigate risks associated with cyber threats.

Advancements in Cloud Technology

The US Secure Access Services Edge Market is being propelled by advancements in cloud technology. As organizations increasingly migrate their operations to the cloud, the demand for secure access services that seamlessly integrate with cloud environments is on the rise. The market is projected to grow as businesses seek solutions that provide secure connectivity to cloud applications while ensuring data integrity and confidentiality. In 2025, it was estimated that over 80% of enterprises in the US would utilize cloud services, further emphasizing the need for secure access solutions tailored to cloud environments. This trend indicates that the US Secure Access Services Edge Market will likely experience substantial growth as organizations prioritize secure access to their cloud-based resources.

Increased Focus on User Experience

The US Secure Access Services Edge Market is increasingly focusing on enhancing user experience. Organizations recognize that providing secure access solutions must not compromise usability. As a result, there is a growing emphasis on developing secure access services that are user-friendly and efficient. This trend is likely to drive market growth as businesses seek to balance security with a seamless user experience. In 2025, it was reported that organizations prioritizing user experience in their security solutions experienced a 30% increase in employee satisfaction and productivity. This suggests that the US Secure Access Services Edge Market will continue to evolve, with a focus on creating solutions that meet both security and usability requirements.

Regulatory Compliance Requirements

The US Secure Access Services Edge Market is significantly shaped by the increasing regulatory compliance requirements imposed on organizations. With the introduction of stringent data protection laws, such as the California Consumer Privacy Act (CCPA) and the Health Insurance Portability and Accountability Act (HIPAA), businesses are compelled to adopt secure access solutions that ensure compliance with these regulations. The market is expected to grow as organizations seek to avoid hefty fines and reputational damage associated with non-compliance. In 2025, it was reported that over 60% of US companies faced challenges in meeting compliance standards, highlighting the critical need for secure access services that facilitate adherence to regulatory mandates. Consequently, the US Secure Access Services Edge Market is likely to see increased investment in compliance-driven security solutions.

Growing Demand for Remote Work Solutions

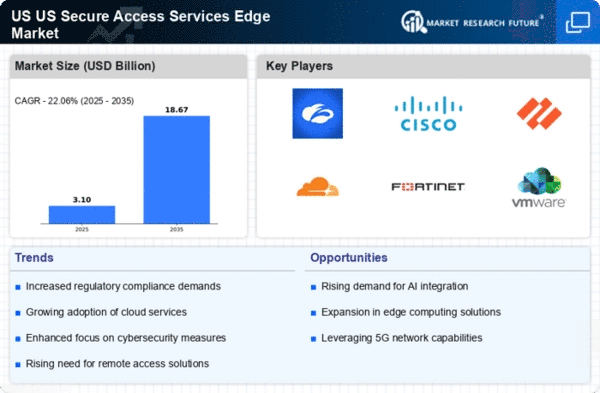

The US Secure Access Services Edge Market is experiencing a notable surge in demand for remote work solutions. As organizations increasingly adopt hybrid work models, the need for secure and efficient access to corporate resources from various locations has become paramount. This shift has led to a projected growth rate of approximately 20% annually in the market, as companies seek to implement secure access services that facilitate remote collaboration while ensuring data protection. The integration of secure access services with existing IT infrastructure is essential for organizations aiming to maintain productivity and security in a distributed work environment. Consequently, the US Secure Access Services Edge Market is likely to witness a significant influx of investments aimed at enhancing remote work capabilities, thereby driving market expansion.