Research methodology on Secure Access Services Edge Market

Research Overview

Secure Access Services Edge (SASE) is a set of integrated networking and security services that are delivered in the cloud to provide secure access to applications and networks both inside and outside of the enterprise network. It is a new model that is gaining traction with organizations looking to simplify their security stack, provide more secure access, and gain greater visibility and control over their users and applications.

The purpose of this research is to gain an understanding of the current market for Secure Access Services Edge (SASE) solutions, the key trends driving its growth, the challenges and opportunities for providers, and the competitive dynamics of the market.

Research Objectives

The objective of this research is to gain an understanding of the current Secure Access Services Edge (SASE) market and its key drivers, including the following:

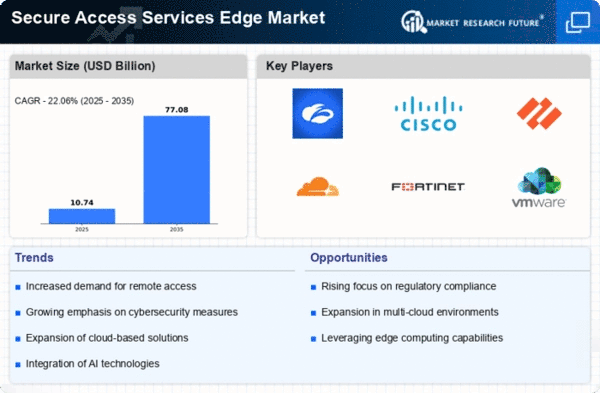

- Understand the overall market size, key segments, growth rate estimates, and regional distribution of the SASE market.

- Identify the key trends driving the growth of the SASE market and the challenges that providers face.

- Identify the competitive dynamics in the Global SASE market, including major players and their competitive strategies.

- Analyze the impact of regulatory and technological advancements on SASE market growth.

Research Methodology

In order to achieve the research objectives, this research report utilizes a combination of both primary and secondary research methods.

Primary Research

For primary research, a range of in-depth interviews and surveys are conducted with industry experts, business leaders, and vendors in the Secure Access Services Edge (SASE) market. Key questions focus on market segments, competitive dynamics, growth opportunities, and challenges for providers. Additional primary research sources, such as client field tests, trade shows, groundbreaking events, and other related events are also utilized to gain a full understanding of the Secure Access Services Edge (SASE) market.

Secondary Research

For secondary research, this report draws on the extensive databases of Market Research Future, which include market reports, industry reports, analyst reports, data portals, and publicly available data sources. Additional sources, such as whitepapers, specialized journals, research institutions, online databases, and internet search engines will also be utilized. Relevant sources of financial data, such as annual reports and financial statements will also be used to gain a full understanding of the market.

Data Analysis

All primary and secondary research data gathered through both qualitative and quantitative research methods are analyzed using a range of tools and techniques, including spreadsheet analysis and text analytics. The data is then used to produce a comprehensive analysis of the market.