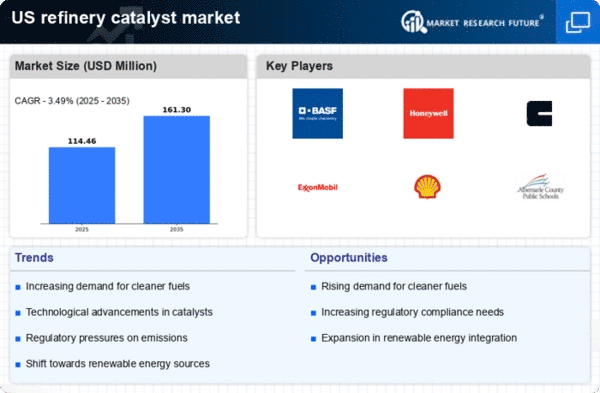

The refinery catalyst market is currently characterized by a dynamic competitive landscape, driven by the increasing demand for cleaner fuels and the need for enhanced operational efficiencies. Key players such as BASF (DE), Honeywell (US), and ExxonMobil (US) are strategically positioned to leverage innovation and technological advancements. BASF (DE) focuses on developing high-performance catalysts that meet stringent environmental regulations, while Honeywell (US) emphasizes digital transformation and automation in refining processes. ExxonMobil (US) is actively pursuing partnerships to enhance its catalyst offerings, thereby shaping a competitive environment that prioritizes sustainability and efficiency.In terms of business tactics, companies are increasingly localizing manufacturing to reduce lead times and optimize supply chains. The market appears moderately fragmented, with several key players exerting significant influence. This structure allows for a diverse range of products and services, catering to various customer needs while fostering competition among established and emerging firms.

In October BASF (DE) announced the launch of a new line of catalysts designed specifically for low-sulfur fuel production. This strategic move is likely to enhance BASF's market share by addressing the growing regulatory pressures for cleaner fuels. The introduction of these catalysts not only aligns with global sustainability goals but also positions BASF as a leader in innovation within the sector.

In September Honeywell (US) unveiled its latest digital platform aimed at optimizing refinery operations through advanced analytics and AI integration. This initiative is expected to significantly improve operational efficiencies and reduce costs for refinery operators. By harnessing data-driven insights, Honeywell (US) is likely to strengthen its competitive edge and appeal to clients seeking to modernize their refining processes.

In August ExxonMobil (US) entered into a strategic partnership with a leading technology firm to co-develop next-generation catalysts that enhance the conversion of heavy crude oil. This collaboration is indicative of ExxonMobil's commitment to innovation and its proactive approach to addressing the challenges posed by evolving market demands. Such partnerships may facilitate the development of more efficient and environmentally friendly refining solutions.

As of November the competitive trends in the refinery catalyst market are increasingly defined by digitalization, sustainability, and the integration of AI technologies. Strategic alliances among key players are shaping the landscape, fostering innovation and collaboration. The shift from price-based competition to a focus on technological advancements and supply chain reliability is evident. Moving forward, companies that prioritize innovation and sustainability are likely to differentiate themselves in a market that is evolving rapidly.