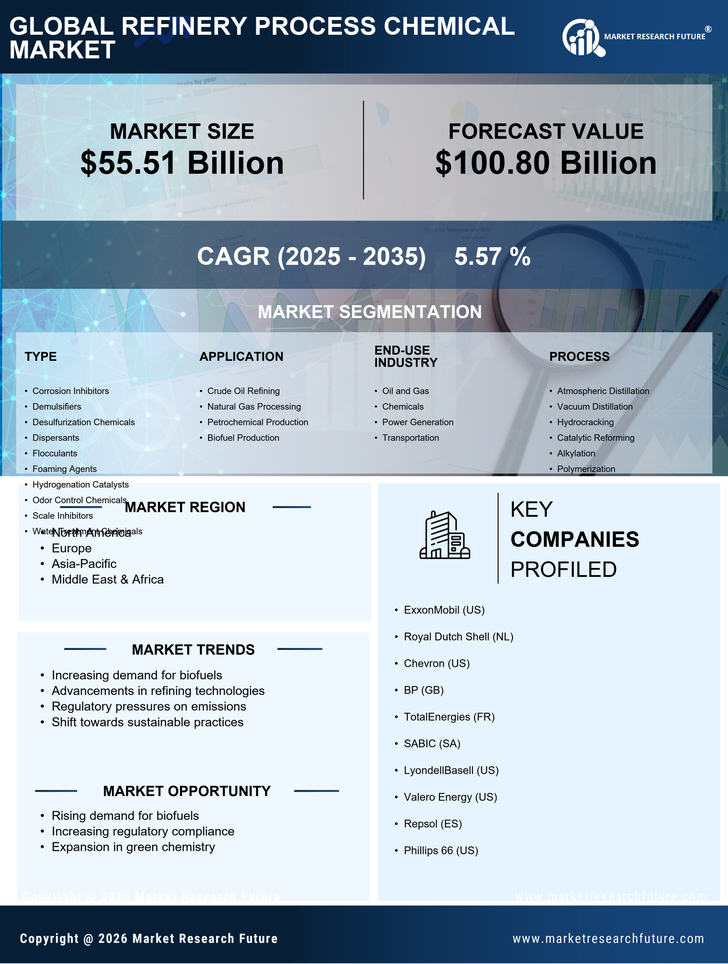

Rising Global Energy Consumption

The continuous rise in The Refinery Process Chemical Industry. As populations grow and economies develop, the demand for energy, particularly in emerging markets, is expected to escalate. This increase in energy consumption drives the need for refined petroleum products, which in turn boosts the demand for refinery process chemicals. According to projections, energy consumption is anticipated to rise by over 25% by 2040, necessitating enhanced refining capabilities. Consequently, refiners are likely to invest in advanced chemicals that improve the efficiency of their processes, thereby fostering growth within the refinery process chemical sector. This trend underscores the critical role of refinery process chemicals in meeting the energy needs of a growing global population.

Increasing Demand for Petrochemicals

The rising demand for petrochemicals is a primary driver of the Refinery Process Chemical Market. As industries such as automotive, construction, and consumer goods expand, the need for various petrochemical products, including plastics and synthetic fibers, continues to grow. In 2025, the petrochemical sector is projected to account for a substantial portion of the overall chemical market, with estimates suggesting a value exceeding 600 billion USD. This surge in demand necessitates the efficient processing of crude oil, thereby propelling the Refinery Process Chemical Market forward. Furthermore, the shift towards lighter and more complex hydrocarbons in refining processes indicates a need for advanced chemicals that enhance yield and efficiency, further stimulating market growth.

Shift Towards Renewable Energy Sources

The transition towards renewable energy sources is reshaping the Refinery Process Chemical Market. As countries commit to reducing carbon emissions, there is a growing emphasis on biofuels and other renewable energy alternatives. This shift is prompting traditional refineries to adapt their processes and incorporate renewable feedstocks, which often require different chemical processes and catalysts. The market for refinery process chemicals is expected to evolve as refiners seek to optimize their operations for biofuel production, potentially leading to an increase in demand for specific chemicals that facilitate these new processes. This trend indicates a significant transformation within the industry, as companies strive to balance traditional refining with innovative renewable solutions.

Technological Innovations in Refining Processes

Technological advancements are a crucial driver of the Refinery Process Chemical Market. Innovations such as advanced catalytic processes, digital monitoring systems, and automation are enhancing the efficiency and effectiveness of refining operations. These technologies not only improve yield but also reduce operational costs, making them attractive to refiners. For example, the implementation of real-time data analytics allows for better decision-making and optimization of chemical usage in refining processes. As these technologies continue to develop, the demand for specialized refinery process chemicals that support these innovations is likely to increase, further propelling market growth. The integration of technology into refining processes signifies a pivotal shift towards more efficient and sustainable operations.

Regulatory Compliance and Environmental Standards

Stringent regulatory frameworks and environmental standards are increasingly influencing the Refinery Process Chemical Market. Governments worldwide are implementing stricter emissions regulations and sustainability initiatives aimed at reducing the environmental impact of refining operations. Compliance with these regulations often requires the adoption of advanced refining technologies and the use of specialized chemicals that minimize emissions and waste. For instance, the introduction of low-sulfur fuels has necessitated the use of specific refining chemicals to meet quality standards. As a result, the market for refinery process chemicals is likely to expand as refiners invest in technologies and chemicals that ensure compliance while maintaining operational efficiency.