US Polyvinyl Alcohol Fiber Market Summary

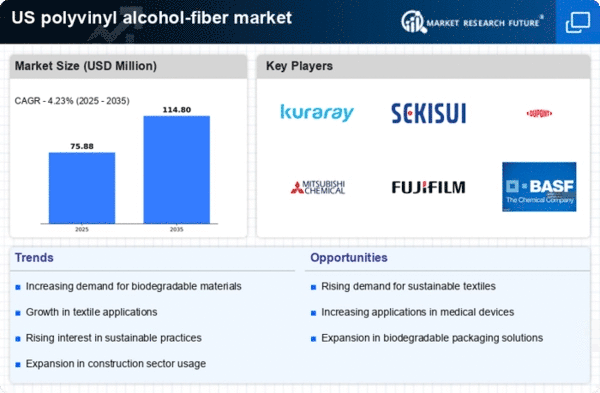

As per Market Research Future analysis, the US polyvinyl alcohol-fiber market size was estimated at 72.8 USD Million in 2024. The US polyvinyl alcohol-fiber market is projected to grow from 75.88 USD Million in 2025 to 114.8 USD Million by 2035, exhibiting a compound annual growth rate (CAGR) of 4.2% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The US polyvinyl alcohol-fiber market is experiencing a transformative shift towards sustainability and innovation.

- The market is increasingly driven by a focus on sustainable practices and biodegradable materials.

- Technological advancements are enhancing the performance and applications of polyvinyl alcohol fibers in various industries.

- The textile segment remains the largest, while the construction sector is identified as the fastest-growing application area.

- Rising demand in textile applications and regulatory support for sustainable practices are key drivers propelling market growth.

Market Size & Forecast

| 2024 Market Size | 72.8 (USD Million) |

| 2035 Market Size | 114.8 (USD Million) |

| CAGR (2025 - 2035) | 4.23% |

Major Players

Kuraray Co Ltd (JP), Sekisui Chemical Co Ltd (JP), E.I. du Pont de Nemours and Company (US), Mitsubishi Chemical Corporation (JP), Fujifilm Holdings Corporation (JP), BASF SE (DE), SABIC (SA), Solvay SA (BE), Huaian Daguangming Chemical Co Ltd (CN)