Regulatory Support

Regulatory frameworks promoting the use of sustainable materials are influencing the Polyvinyl Alcohol Fiber Market positively. Governments are implementing policies that encourage the adoption of biodegradable and eco-friendly materials, which aligns with the properties of polyvinyl alcohol fibers. This regulatory support not only fosters innovation but also incentivizes manufacturers to transition towards more sustainable practices. As a result, companies are likely to invest in research and development to enhance the performance of polyvinyl alcohol fibers, thereby expanding their market presence. The anticipated increase in regulatory measures aimed at reducing plastic waste could further bolster the demand for polyvinyl alcohol fibers, potentially leading to a market growth rate of around 10% in the upcoming years.

Rising Consumer Awareness

The growing awareness among consumers regarding environmental issues is significantly impacting the Polyvinyl Alcohol Fiber Market. As consumers become more informed about the environmental implications of their purchases, there is a marked shift towards products that are sustainable and biodegradable. This trend is particularly evident in the textile and packaging sectors, where consumers are actively seeking alternatives to conventional synthetic fibers. The demand for eco-friendly products is expected to drive manufacturers to prioritize the development of polyvinyl alcohol fibers, which are perceived as a responsible choice. Market Research Future indicates that consumer preference for sustainable materials could lead to a substantial increase in the market share of polyvinyl alcohol fibers, with projections suggesting a growth rate of approximately 11% over the next few years.

Technological Innovations

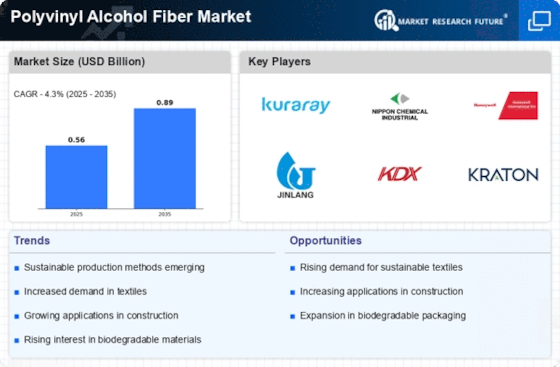

Technological advancements play a pivotal role in shaping the Polyvinyl Alcohol Fiber Market. Innovations in fiber production techniques, such as advanced spinning methods and improved polymerization processes, have led to enhanced fiber properties, including increased strength and durability. These improvements enable the fibers to be utilized in a wider array of applications, from medical textiles to construction materials. Furthermore, the integration of smart technologies, such as IoT and AI, into manufacturing processes is expected to optimize production efficiency and reduce waste. As a result, the market is likely to witness a surge in demand for high-performance polyvinyl alcohol fibers, with projections indicating a potential market growth of 15% over the next five years.

Sustainability Initiatives

The increasing emphasis on sustainability within the Polyvinyl Alcohol Fiber Market is driving demand for eco-friendly materials. As industries seek to reduce their carbon footprint, the biodegradable nature of polyvinyl alcohol fibers becomes a compelling alternative to traditional synthetic fibers. This shift is evident in sectors such as textiles and packaging, where companies are actively pursuing sustainable practices. The market for biodegradable fibers is projected to grow significantly, with estimates suggesting a compound annual growth rate of over 10% in the coming years. This trend not only aligns with consumer preferences for environmentally responsible products but also encourages manufacturers to innovate and invest in sustainable production methods, thereby enhancing the overall appeal of the Polyvinyl Alcohol Fiber Market.

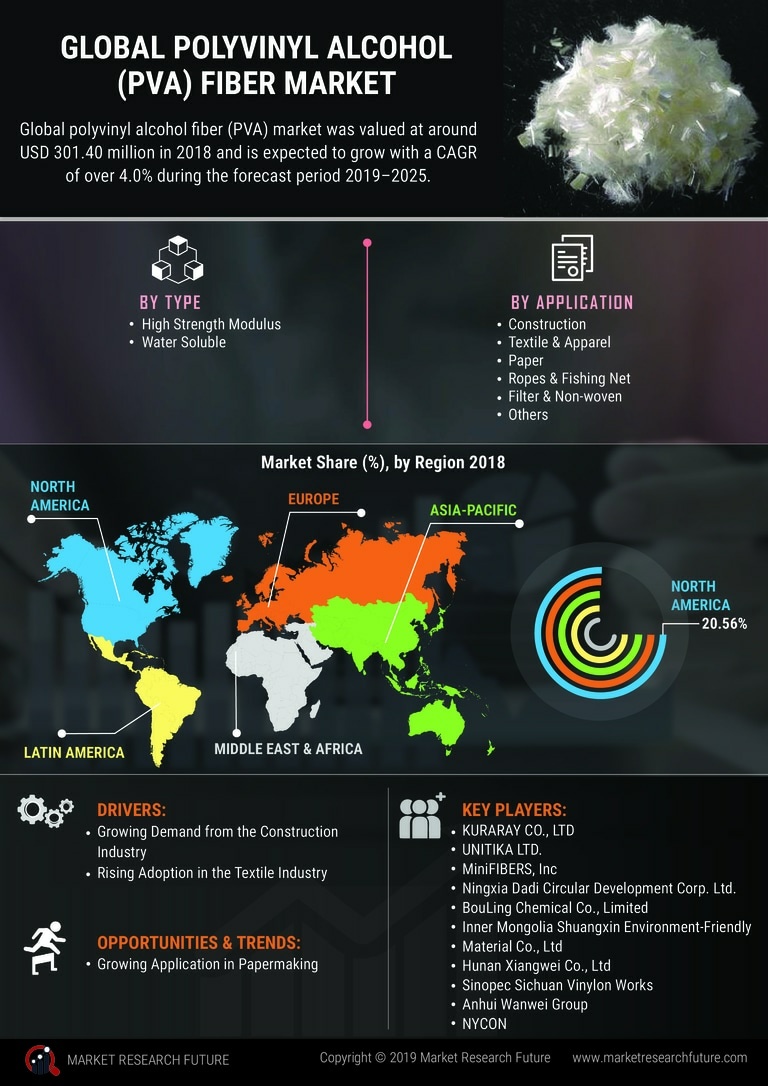

Diverse End-Use Applications

The versatility of polyvinyl alcohol fibers is a significant driver for the Polyvinyl Alcohol Fiber Market. These fibers find applications across various sectors, including textiles, automotive, and construction. In the textile industry, they are increasingly used in the production of non-woven fabrics, which are gaining popularity due to their lightweight and durable characteristics. Additionally, the automotive sector is adopting polyvinyl alcohol fibers for their lightweight properties, contributing to fuel efficiency. The construction industry also benefits from these fibers, as they enhance the strength and durability of concrete. With the expansion of applications, the market is projected to grow at a rate of approximately 12% annually, reflecting the increasing recognition of polyvinyl alcohol fibers' benefits.