North America : Established Market with Growth Potential

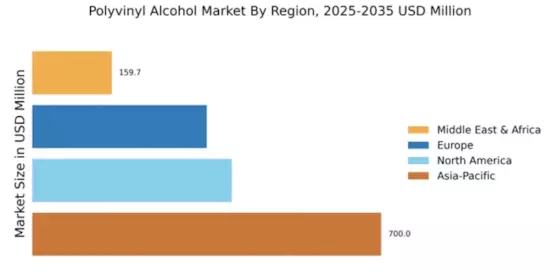

The North American Polyvinyl Alcohol market is projected to reach $400.0 million by 2025, driven by increasing demand in various applications such as packaging, textiles, and adhesives. Regulatory support for sustainable materials is also a significant catalyst, encouraging manufacturers to innovate and adopt eco-friendly practices. The region's focus on research and development further enhances market growth, positioning it as a key player in the global landscape. Leading countries like the US and Canada dominate the market, with major players such as DuPont and Kuraray establishing a strong presence. The competitive landscape is characterized by strategic partnerships and technological advancements, enabling companies to meet the rising demand for high-performance materials. The emphasis on quality and sustainability is shaping the market dynamics, ensuring a robust growth trajectory for the region.

Europe : Innovation and Sustainability Focus

Europe's Polyvinyl Alcohol market is expected to reach $350.0 million by 2025, fueled by increasing applications in the automotive, construction, and textile industries. The region's commitment to sustainability and stringent regulations on plastic usage are driving demand for eco-friendly alternatives. This regulatory environment encourages innovation, leading to the development of advanced PVA products that meet market needs. Germany, France, and the UK are leading countries in this market, with key players like Ems-Chemie and Sekisui Chemical actively participating. The competitive landscape is marked by a focus on research and development, enabling companies to introduce innovative solutions. The presence of established manufacturers and a growing emphasis on sustainable practices position Europe as a significant player in The Polyvinyl Alcohol.

Asia-Pacific : Dominant Market with High Demand

The Asia-Pacific region is the largest market for Polyvinyl Alcohol, projected to reach $700.0 million by 2025. This growth is driven by rapid industrialization, increasing demand in packaging, and the textile sector. Countries like China and Japan are at the forefront, supported by favorable government policies and investments in manufacturing capabilities. The region's focus on innovation and sustainability is also a key driver of market expansion. China, Japan, and South Korea are leading players in this market, with major companies such as Kuraray and Mitsubishi Chemical dominating the landscape. The competitive environment is characterized by a mix of local and international players, fostering innovation and technological advancements. The presence of a robust supply chain and increasing consumer awareness about sustainable products further enhance the region's market position.

Middle East and Africa : Emerging Market with Growth Opportunities

The Middle East and Africa Polyvinyl Alcohol market is projected to reach $159.68 million by 2025, driven by increasing demand in construction and packaging sectors. The region's growing industrial base and investments in infrastructure development are significant growth drivers. Additionally, the rising awareness of sustainable materials is encouraging manufacturers to explore eco-friendly alternatives, further boosting market potential. Countries like South Africa and the UAE are emerging as key players in this market, with local manufacturers and international companies seeking to expand their footprint. The competitive landscape is evolving, with a focus on innovation and strategic partnerships. As the region continues to develop, the demand for Polyvinyl Alcohol is expected to rise, presenting numerous opportunities for growth.