US Paper Pigments Market Summary

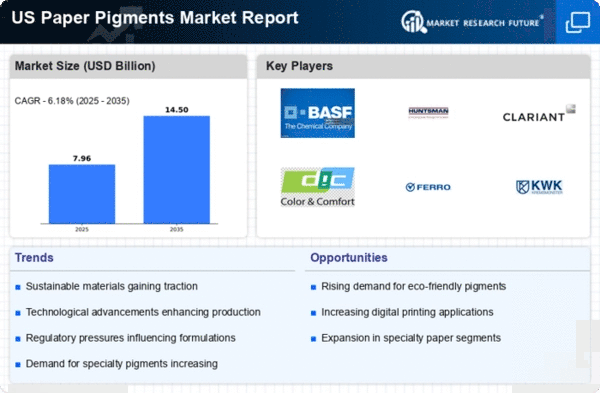

As per Market Research Future analysis, the US paper pigments market Size was estimated at 7.5 USD Billion in 2024. The US paper pigments market is projected to grow from 7.96 USD Billion in 2025 to 14.5 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 6.1% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The US paper pigments market is experiencing a transformative shift towards sustainability and quality enhancement.

- The market is increasingly driven by a sustainability focus, with manufacturers prioritizing eco-friendly pigment options.

- Technological advancements in pigment production are enhancing efficiency and product quality, appealing to discerning consumers.

- The demand for high-quality paper products is rising, particularly in the packaging and printing segments, which are the largest in the market.

- Key market drivers include the increased demand for eco-friendly products and the growth in the packaging sector, which is rapidly expanding.

Market Size & Forecast

| 2024 Market Size | 7.5 (USD Billion) |

| 2035 Market Size | 14.5 (USD Billion) |

| CAGR (2025 - 2035) | 6.18% |

Major Players

BASF SE (DE), Huntsman Corporation (US), Clariant AG (CH), DIC Corporation (JP), Ferro Corporation (US), Kremsmünster (AT), Toyo Ink SC Holdings Co., Ltd. (JP), SABIC (SA)