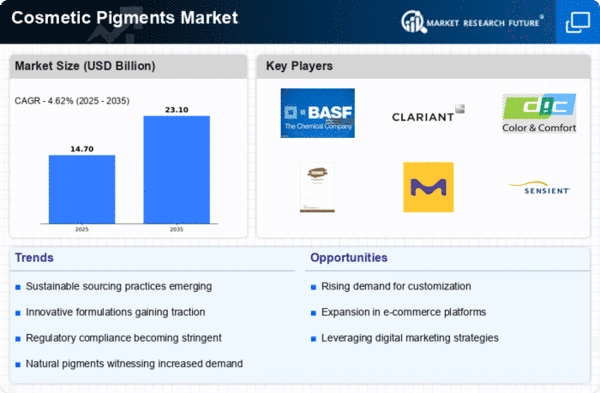

Market Growth Projections

The Global Cosmetic Pigment Market Industry is on a growth trajectory, with projections indicating a compound annual growth rate of 6.35% from 2025 to 2035. This growth is fueled by various factors, including increasing consumer demand for innovative cosmetic products and the expansion of the e-commerce sector. The market is expected to reach 12.1 USD Billion in 2024, with a further increase to 23.8 USD Billion by 2035. These figures suggest a robust market environment, driven by evolving consumer preferences and advancements in pigment technology.

Growth of the E-commerce Sector

The rise of e-commerce is significantly influencing the Global Cosmetic Pigment Market Industry. Online retail platforms provide consumers with easy access to a wide range of cosmetic products, including those featuring innovative pigments. The convenience of online shopping, coupled with targeted marketing strategies, has led to increased sales of cosmetic products. In 2024, the market is projected to reach 12.1 USD Billion, with e-commerce contributing a substantial share. This trend is expected to continue, as more consumers prefer the convenience of purchasing cosmetics online, thereby driving market growth.

Rising Demand for Natural Pigments

The Global Cosmetic Pigment Market Industry is witnessing a notable shift towards natural pigments, driven by consumer preferences for organic and eco-friendly products. As awareness of synthetic chemicals' potential harm increases, brands are reformulating their products to include plant-based pigments. This trend is reflected in the growing market share of natural pigments, which is projected to reach a significant portion of the overall market by 2035. The increasing demand for sustainable beauty products is expected to contribute to the market's growth, with natural pigments becoming a key component in cosmetic formulations.

Increasing Awareness of Skin Health

There is a growing awareness of skin health among consumers, which is impacting the Global Cosmetic Pigment Market Industry. As individuals become more informed about the effects of various ingredients on skin health, they are seeking products that not only enhance appearance but also provide skin benefits. This trend is leading to the formulation of cosmetics that incorporate pigments with added skincare properties. Brands are responding by developing products that cater to this demand, thereby expanding their market presence. The focus on skin health is likely to drive innovation and growth in the cosmetic pigment sector.

Regulatory Support for Cosmetic Safety

Regulatory frameworks supporting cosmetic safety are shaping the Global Cosmetic Pigment Market Industry. Governments worldwide are implementing stricter regulations to ensure the safety and efficacy of cosmetic products, including pigments. This regulatory environment encourages manufacturers to invest in safer, high-quality pigments, fostering consumer trust. As a result, the market is expected to grow, with projections indicating a rise to 23.8 USD Billion by 2035. Compliance with these regulations not only enhances product safety but also drives innovation in pigment development, ultimately benefiting the industry.

Technological Advancements in Pigment Production

Innovations in pigment production technology are playing a crucial role in the Global Cosmetic Pigment Market Industry. Advanced manufacturing processes, such as nanotechnology and microencapsulation, enhance the stability and performance of pigments in cosmetic applications. These technologies allow for the creation of more vibrant colors and improved product longevity. As a result, manufacturers are increasingly adopting these innovations to meet consumer expectations for high-quality cosmetics. The integration of technology not only boosts product appeal but also aligns with the industry's shift towards more sustainable practices, potentially impacting market dynamics positively.