Growing Interest in Plant-Based Diets

The organic fruits-vegetables market is benefiting from the rising interest in plant-based diets among consumers. As more individuals adopt vegetarian or vegan lifestyles, the demand for organic produce is expected to increase significantly. Research indicates that plant-based diets can lead to improved health outcomes, which resonates with health-conscious consumers. In 2025, sales of organic fruits and vegetables are projected to reach $20 billion in the US, driven by this dietary shift. This trend not only supports the growth of the organic fruits-vegetables market but also encourages farmers to diversify their offerings to meet the evolving preferences of consumers.

Technological Advancements in Farming

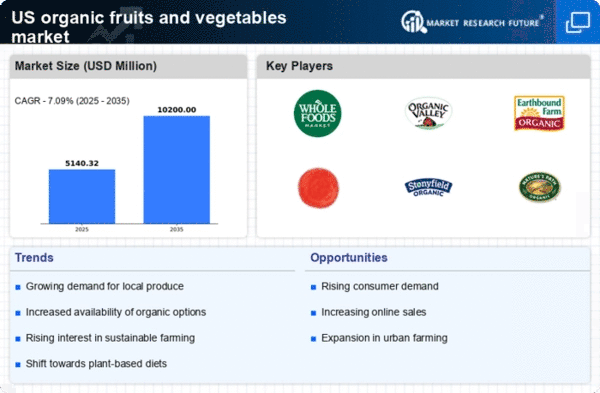

Technological innovations are playing a crucial role in shaping the organic fruits-vegetables market. The integration of precision agriculture, data analytics, and biotechnology is enabling farmers to optimize yields while adhering to organic standards. For instance, the use of drones for monitoring crop health and soil conditions has become increasingly prevalent. This not only enhances productivity but also reduces waste, making organic farming more efficient. As a result, the market is projected to grow at a CAGR of around 10% over the next five years, driven by these advancements. The organic fruits-vegetables market is thus positioned to leverage technology to meet rising consumer demands for quality and sustainability.

Government Support for Organic Farming

Government initiatives aimed at promoting organic farming are significantly impacting the organic fruits-vegetables market. Various programs and subsidies are designed to support farmers transitioning to organic practices, thereby increasing the supply of organic produce. In 2025, federal funding for organic agriculture is projected to exceed $500 million, reflecting the government's commitment to sustainable farming. This support not only aids farmers in overcoming initial challenges associated with organic certification but also enhances consumer confidence in organic products. Consequently, the organic fruits-vegetables market is likely to experience sustained growth as more farmers adopt organic practices, bolstered by governmental backing.

Increased Demand for Sustainable Practices

The organic fruits-vegetables market is experiencing a notable surge in demand for sustainable agricultural practices. Consumers are increasingly aware of the environmental impact of conventional farming methods, leading to a preference for organic produce. This shift is reflected in the market, where organic fruits and vegetables accounted for approximately 15% of total produce sales in the US in 2025. The emphasis on sustainability not only appeals to eco-conscious consumers but also encourages farmers to adopt organic practices, thereby enhancing the overall market growth. As more consumers seek transparency in food sourcing, the organic fruits-vegetables market is likely to benefit from this trend, fostering a more sustainable food system that aligns with consumer values.

Enhanced Retail Availability and Accessibility

The organic fruits-vegetables market is witnessing improved retail availability and accessibility, which is crucial for market expansion. Major grocery chains and specialty stores are increasingly dedicating shelf space to organic products, making them more accessible to consumers. Additionally, the rise of online grocery shopping has further facilitated access to organic produce. In 2025, it is estimated that organic fruits and vegetables will represent 20% of total produce sales in retail outlets. This enhanced availability not only caters to the growing consumer demand but also encourages new entrants into the organic fruits-vegetables market, fostering competition and innovation.