Rising Prevalence of Eye Disorders

The US Ophthalmic Drugs Devices Market is experiencing growth due to the increasing prevalence of eye disorders such as glaucoma, diabetic retinopathy, and age-related macular degeneration. According to the National Eye Institute, the number of Americans with vision impairment is projected to double by 2050, reaching approximately 8 million. This rising incidence necessitates the development and adoption of innovative ophthalmic drugs and devices, thereby driving market expansion. Furthermore, the aging population in the United States is particularly susceptible to these conditions, which further amplifies the demand for effective treatment options. As healthcare providers focus on addressing these challenges, the US Ophthalmic Drugs Devices Market is likely to see a surge in investments aimed at research and development, ultimately enhancing patient outcomes.

Technological Innovations in Ophthalmology

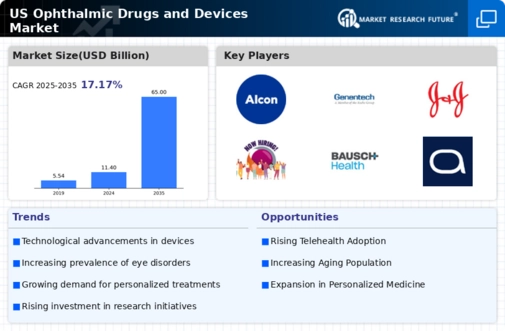

Technological advancements are a pivotal driver in the US Ophthalmic Drugs Devices Market. Innovations such as telemedicine, artificial intelligence, and minimally invasive surgical techniques are transforming the landscape of eye care. For instance, the integration of AI in diagnostic tools has improved the accuracy of detecting eye diseases, leading to timely interventions. The market for ophthalmic devices is projected to grow significantly, with estimates suggesting a compound annual growth rate of over 5% through 2028. These advancements not only enhance the efficacy of treatments but also improve patient accessibility to care. As technology continues to evolve, the US Ophthalmic Drugs Devices Market is poised for substantial growth, driven by the demand for cutting-edge solutions that cater to diverse patient needs.

Growing Awareness and Education on Eye Health

The US Ophthalmic Drugs Devices Market is benefiting from increased awareness and education regarding eye health. Public health campaigns and initiatives aimed at educating the population about the importance of regular eye examinations and early detection of eye diseases are gaining traction. Organizations such as the American Academy of Ophthalmology are actively promoting eye health awareness, which is likely to lead to higher patient engagement and demand for ophthalmic services. As more individuals recognize the significance of maintaining eye health, the market for ophthalmic drugs and devices is expected to expand. This heightened awareness not only drives demand for existing products but also encourages the development of new solutions tailored to the needs of the population, thereby propelling the US Ophthalmic Drugs Devices Market forward.

Increased Investment in Research and Development

Investment in research and development (R&D) is a crucial driver for the US Ophthalmic Drugs Devices Market. Pharmaceutical companies and medical device manufacturers are allocating significant resources to develop novel therapies and devices that address unmet medical needs. The US government, through initiatives like the National Institutes of Health, supports R&D efforts, fostering innovation in ophthalmic treatments. In 2023, R&D spending in the ophthalmic sector reached approximately $5 billion, reflecting a commitment to advancing eye care. This influx of funding is likely to lead to breakthroughs in drug formulations and device technologies, ultimately enhancing treatment options for patients. As R&D continues to thrive, the US Ophthalmic Drugs Devices Market is expected to benefit from a steady stream of innovative products entering the market.

Regulatory Support and Streamlined Approval Processes

Regulatory support plays a vital role in shaping the US Ophthalmic Drugs Devices Market. The Food and Drug Administration (FDA) has implemented streamlined approval processes for innovative ophthalmic products, facilitating quicker access to the market. This regulatory environment encourages manufacturers to invest in the development of new drugs and devices, knowing that they can navigate the approval process more efficiently. In recent years, the FDA has introduced initiatives aimed at expediting the review of breakthrough therapies, which is particularly beneficial for conditions with limited treatment options. As a result, the US Ophthalmic Drugs Devices Market is likely to witness an influx of novel products, enhancing competition and ultimately benefiting patients through improved treatment options.