Leading market players are investing heavily in research and development to expand their product lines, which will help the Aerospace Additive Manufacturing Market grow even more. Market participants are also undertaking various strategic activities to expand their footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, the aerospace additive manufacturing industry must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics manufacturers use in the aerospace additive manufacturing industry to benefit clients and increase the market sector. In recent years, the aerospace additive manufacturing industry has offered some of the most significant technological advantages.

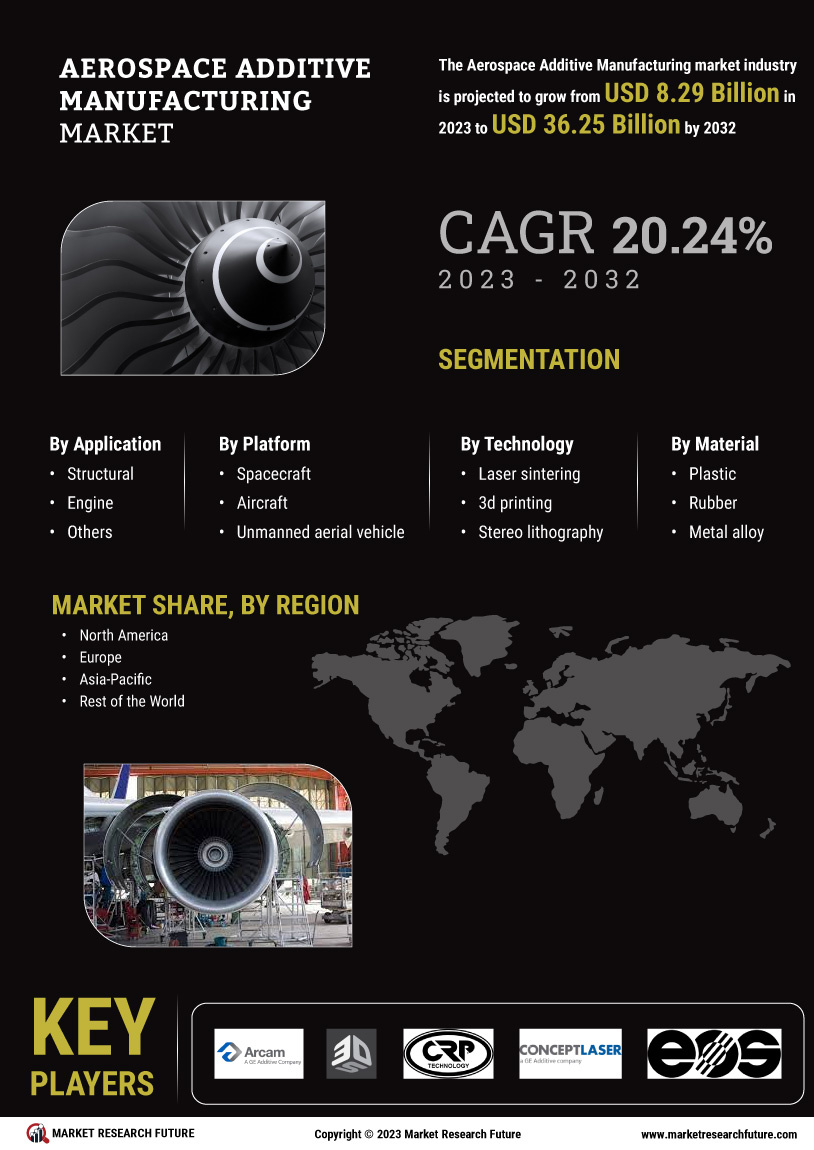

Major players in the aerospace additive manufacturing market, including Arcam AB (Sweden), 3d Systems Inc. (U.S.), CRP Technology SRL (Italy), Concept laser GMBH I (Germany), Eos (Germany), CRS Holdings Inc. (U.S.), Optomec (U.S.), Stratasys ltd (U.S.), Exone (U.S.), SLM solution group AG (Germany), and others, are attempting to increase market demand by investing in research and development operations.

GE Additive, a division of General Electric (NYSE GE), is a frontrunner in metal additive design and manufacturing. Our comprehensive offering of additive expertise, cutting-edge machinery, and premium powders equip our customers to create novel products. Products that address issues in manufacturing boost corporate performance and effect positive social change. Concept Laser and Arcam EBM are two additive machine brands owned by GE Additive and additive powder supplier AP&C.

In October GE Additive's Binder Jet Line and Series 3 printer had more specifications made public.

After four years of client discovery, collaboration, and testing, the system will be released in the second half of 2023, ready and relevant for modern, high-volume, serial production scenarios.

In 1986, 3D Systems pioneered the 3D printing business, and ever since then, the Company has been at the forefront of additive manufacturing advancements. From plastics to metals, our Applications Innovation Group provides industry-specific engineering knowledge to support our extensive hardware, software, and material solutions portfolio. We use a collaborative, application-centric approach when resolving your most pressing design and manufacturing issues. Our customers can overcome traditional manufacturing barriers and fully realize the potential of additive manufacturing thanks to the combination of our solutions, expertise, and innovation.

Founded in 1984 and headquartered in Rock Hill, South Carolina, 3D Systems has expanded its footprint to include offices, manufacturing sites, and Customer Innovation Centers.

In December An additive manufacturing system for producing electrical connectors in compliance with demanding UL regulatory criteria was collaboratively developed by 3D Systems and TE Connectivity, a leader in connectors and sensors.