Cost Efficiency

Cost efficiency is a significant factor influencing the Global Additive Manufacturing With Metal Powders Market Industry. The ability to reduce material waste and streamline production processes leads to lower overall costs. Industries such as healthcare and automotive are increasingly adopting additive manufacturing to produce complex parts at a fraction of the cost of traditional methods. This trend is likely to drive market expansion, as organizations seek to optimize their production budgets. The anticipated compound annual growth rate of 25.66% from 2025 to 2035 underscores the financial advantages that additive manufacturing presents.

Sustainability Initiatives

Sustainability is a crucial consideration driving the Global Additive Manufacturing With Metal Powders Market Industry. As industries face increasing pressure to reduce waste and carbon footprints, additive manufacturing offers a more sustainable alternative to traditional methods. The ability to produce components with minimal material waste and energy consumption aligns with global sustainability goals. For instance, companies are leveraging metal powders to create parts that require less energy during production. This shift towards greener manufacturing practices is expected to bolster market growth, particularly as regulations around sustainability tighten.

Technological Advancements

The Global Additive Manufacturing With Metal Powders Market Industry is experiencing rapid technological advancements that enhance production capabilities. Innovations in powder metallurgy and laser sintering techniques are enabling the creation of complex geometries and lightweight structures. For instance, the introduction of multi-laser systems has significantly reduced production times, making it feasible for industries like aerospace and automotive to adopt these technologies. As a result, the market is projected to reach 3.59 USD Billion in 2024, reflecting a growing acceptance of additive manufacturing processes across various sectors.

Global Supply Chain Resilience

The Global Additive Manufacturing With Metal Powders Market Industry is benefiting from a renewed focus on supply chain resilience. Recent disruptions have prompted industries to explore localized production methods, reducing reliance on global supply chains. Additive manufacturing enables on-demand production, allowing companies to respond swiftly to market changes. This shift is particularly relevant for sectors like defense and medical devices, where rapid prototyping and production are critical. As industries prioritize supply chain robustness, the adoption of additive manufacturing is expected to accelerate, further driving market growth.

Increased Demand for Customization

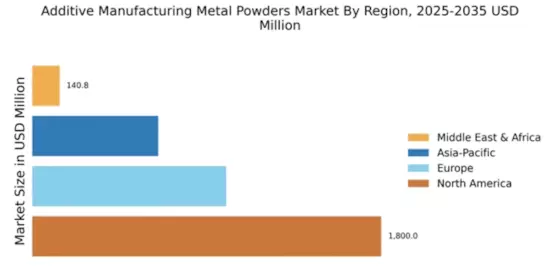

Customization is becoming a pivotal driver in the Global Additive Manufacturing With Metal Powders Market Industry. Industries are increasingly seeking tailored solutions to meet specific requirements, which traditional manufacturing methods often struggle to provide. For example, the aerospace sector benefits from the ability to produce lightweight, customized components that enhance fuel efficiency. This trend is expected to contribute to the market's growth, with projections indicating a rise to 44.3 USD Billion by 2035. The ability to create bespoke parts on demand is likely to reshape production paradigms across multiple sectors.