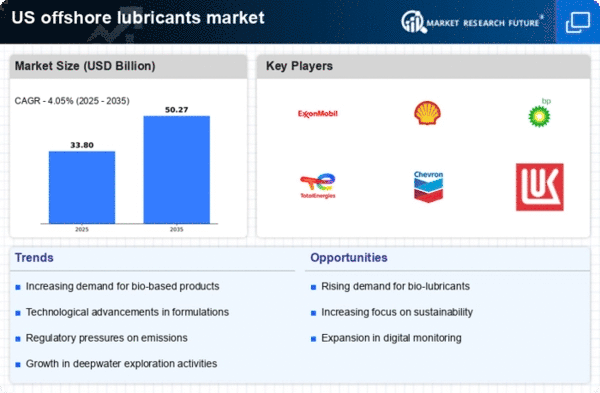

The offshore lubricants market is characterized by a competitive landscape that is increasingly shaped by innovation, sustainability, and strategic partnerships. Key players such as ExxonMobil (US), Shell (GB), and Chevron (US) are actively pursuing strategies that emphasize technological advancements and environmental responsibility. ExxonMobil (US) has focused on enhancing its product portfolio with bio-based lubricants, which aligns with the growing demand for sustainable solutions. Shell (GB) continues to invest in digital transformation initiatives, leveraging data analytics to optimize lubricant performance and customer engagement. Meanwhile, Chevron (US) is expanding its operational footprint through strategic alliances, particularly in emerging markets, which enhances its competitive positioning in the sector.The business tactics employed by these companies reflect a concerted effort to localize manufacturing and optimize supply chains. The offshore lubricants market appears moderately fragmented, with a mix of established players and emerging companies vying for market share. The collective influence of these key players is significant, as they not only drive innovation but also set industry standards that smaller competitors must follow to remain relevant.

In October Shell (GB) announced a partnership with a leading technology firm to develop AI-driven lubricant formulations aimed at improving efficiency and reducing environmental impact. This strategic move underscores Shell's commitment to sustainability while enhancing its competitive edge through cutting-edge technology. The collaboration is expected to yield products that not only meet regulatory standards but also exceed customer expectations in performance and environmental stewardship.

In September Chevron (US) launched a new line of high-performance lubricants specifically designed for offshore drilling operations. This initiative is particularly noteworthy as it addresses the unique challenges faced by operators in harsh marine environments. By tailoring products to meet specific operational needs, Chevron (US) positions itself as a leader in providing specialized solutions, thereby reinforcing its market presence.

In August ExxonMobil (US) expanded its research and development capabilities by opening a new facility dedicated to the innovation of marine lubricants. This investment reflects a strategic focus on enhancing product performance and sustainability. The facility is expected to accelerate the development of next-generation lubricants that align with the industry's shift towards greener alternatives, thereby solidifying ExxonMobil's role as a key player in the market.

As of November the offshore lubricants market is witnessing trends that emphasize digitalization, sustainability, and the integration of advanced technologies such as AI. Strategic alliances are increasingly shaping the competitive landscape, enabling companies to pool resources and expertise to drive innovation. The shift from price-based competition to a focus on technological differentiation and supply chain reliability is evident. Moving forward, companies that prioritize innovation and sustainability are likely to gain a competitive advantage, as the market evolves to meet the demands of a more environmentally conscious consumer base.