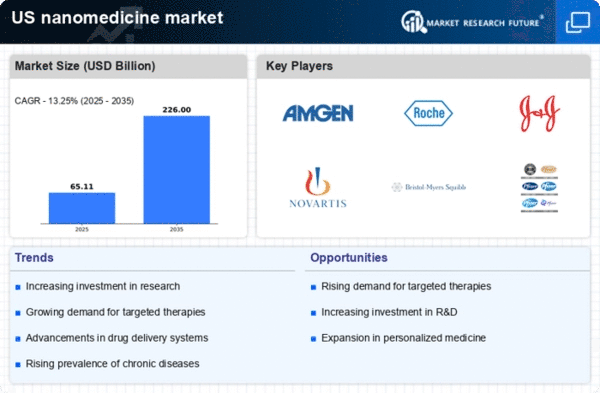

Rising Demand for Targeted Therapies

The increasing prevalence of chronic diseases in the US is driving the demand for targeted therapies, which are a hallmark of the nanomedicine market. As healthcare providers seek more effective treatment options, the ability of nanomedicine to deliver drugs directly to affected cells is becoming increasingly attractive. This precision reduces side effects and enhances therapeutic efficacy. According to recent estimates, the market for targeted therapies is projected to reach approximately $100 billion by 2026, indicating a robust growth trajectory. The shift towards personalized medicine further fuels this trend, as patients and healthcare systems alike prioritize treatments that are tailored to individual needs. Consequently, the rising demand for targeted therapies is a significant driver of growth within the nanomedicine market, as it aligns with broader healthcare trends emphasizing efficacy and patient-centered care.

Increased Investment in Healthcare R&D

The US healthcare sector is experiencing a notable increase in investment in research and development (R&D), which is significantly impacting the nanomedicine market. With healthcare spending projected to reach $6 trillion by 2027, a substantial portion is being allocated to innovative therapies and technologies. This influx of capital is facilitating the exploration of novel nanomedicine applications, including cancer treatment and regenerative medicine. Furthermore, venture capital investments in biotech firms specializing in nanomedicine have surged, with estimates indicating a growth of over 30% in 2025 alone. This trend underscores the confidence investors have in the potential of nanomedicine to revolutionize healthcare, thereby driving the expansion of the market.

Growing Awareness of Nanomedicine Benefits

There is a growing awareness among healthcare professionals and patients regarding the benefits of nanomedicine, which is positively influencing the nanomedicine market. Educational initiatives and conferences are increasingly highlighting the advantages of nanotechnology in improving drug efficacy and reducing adverse effects. As more healthcare providers become informed about the capabilities of nanomedicine, the adoption of these technologies in clinical practice is likely to increase. Surveys indicate that approximately 70% of healthcare professionals believe that nanomedicine will play a crucial role in future treatment paradigms. This heightened awareness is fostering a more favorable environment for the integration of nanomedicine into standard healthcare practices, thereby driving market growth.

Technological Innovations in Nanotechnology

Technological advancements in nanotechnology are propelling the evolution of the nanomedicine market. Innovations such as nanoscale drug delivery systems, nanocarriers, and imaging agents are enhancing the capabilities of medical treatments. For instance, the development of nanoparticles that can cross the blood-brain barrier opens new avenues for treating neurological disorders. The US is witnessing a surge in research and development activities, with funding from both public and private sectors. In 2024, federal funding for nanotechnology research reached approximately $1.5 billion, reflecting the government's commitment to advancing this field. These technological innovations not only improve treatment outcomes but also foster collaborations between academia and industry, further driving growth in the nanomedicine market.

Regulatory Support for Nanomedicine Innovations

Regulatory bodies in the US are increasingly supportive of innovations in the nanomedicine market, which is fostering a conducive environment for development. The FDA has established guidelines for the evaluation of nanotechnology-based products, streamlining the approval process for new therapies. This regulatory clarity is encouraging companies to invest in the development of nanomedicine solutions, as they can navigate the approval landscape more effectively. In 2025, the FDA approved several nanomedicine products, reflecting a trend towards more efficient regulatory pathways. This support not only enhances the market's credibility but also instills confidence among investors and stakeholders, thereby driving further growth in the nanomedicine market.