Rising Demand for Targeted Therapies

The increasing prevalence of chronic diseases in Japan is driving the demand for targeted therapies, which are a hallmark of the nanomedicine market. As the population ages, conditions such as cancer and cardiovascular diseases are becoming more common. This trend is reflected in the market, which is projected to reach approximately $2.5 billion by 2026. The ability of nanomedicine to deliver drugs directly to affected cells minimizes side effects and enhances treatment efficacy. Consequently, pharmaceutical companies are investing heavily in research and development to create innovative nanomedicine solutions, thereby propelling the growth of the nanomedicine market in Japan.

Government Support and Funding Initiatives

The Japanese government is actively supporting the development of the nanomedicine market through various funding initiatives and research grants. Programs aimed at fostering innovation in healthcare technologies are being implemented, which include financial incentives for companies engaged in nanomedicine research. This support is crucial, as it encourages collaboration between academic institutions and industry players, leading to the development of novel therapies. The government’s commitment to enhancing healthcare through nanotechnology is likely to result in a more robust market, with projections indicating a potential market size of $3 billion by 2028.

Growing Awareness of Nanomedicine Benefits

There is a growing awareness among healthcare professionals and patients regarding the benefits of nanomedicine, which is positively impacting the nanomedicine market in Japan. Educational campaigns and seminars are being conducted to inform stakeholders about the advantages of nanotechnology in medicine, such as improved drug efficacy and reduced side effects. This increased awareness is likely to lead to higher adoption rates of nanomedicine solutions in clinical settings. As a result, the market is expected to witness a steady growth trajectory, with estimates suggesting an increase in market share by approximately 20% over the next few years.

Technological Innovations in Nanotechnology

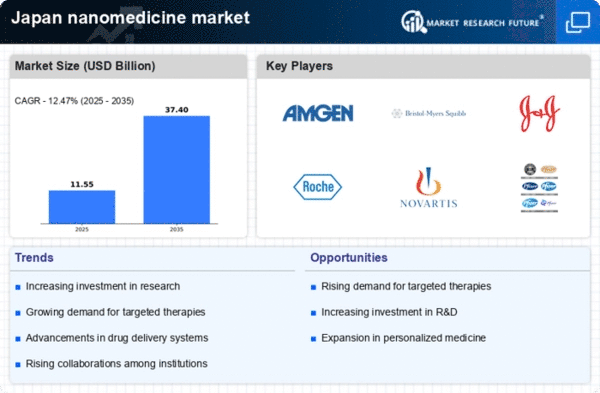

Technological advancements in nanotechnology are significantly influencing the nanomedicine market in Japan. Innovations such as nanocarriers and nanosensors are enhancing drug delivery systems and diagnostic capabilities. For instance, the integration of nanotechnology in imaging techniques allows for earlier detection of diseases, which is crucial for effective treatment. The market for nanotechnology in healthcare is expected to grow at a CAGR of around 15% over the next five years. This growth is indicative of the potential applications of nanotechnology in improving patient outcomes, thus driving the expansion of the nanomedicine market.

Collaborations Between Academia and Industry

Collaborations between academic institutions and industry players are becoming increasingly prevalent in Japan, significantly impacting the nanomedicine market. These partnerships facilitate the translation of research findings into practical applications, accelerating the development of innovative nanomedicine products. Joint ventures often lead to the sharing of resources and expertise, which enhances the overall research output. As a result, the market is likely to benefit from a surge in new product launches and advancements in therapeutic techniques. This collaborative environment is expected to contribute to a market growth rate of around 12% annually, reflecting the dynamic nature of the nanomedicine market.