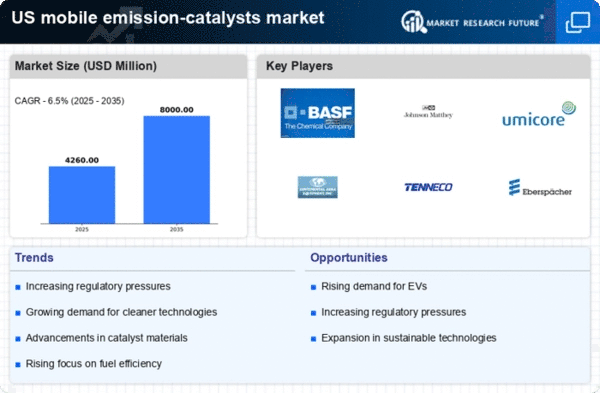

The mobile emission-catalysts market is currently characterized by a dynamic competitive landscape, driven by stringent regulatory frameworks and an increasing emphasis on sustainability. Key players such as BASF SE (Germany), Johnson Matthey PLC (United Kingdom), and Tenneco Inc. (US) are actively shaping the market through innovative product offerings and strategic partnerships. BASF SE (Germany) focuses on enhancing its catalyst technologies to meet evolving emission standards, while Johnson Matthey PLC (United Kingdom) emphasizes its commitment to sustainability through the development of advanced catalytic solutions. Tenneco Inc. (US) is leveraging its extensive manufacturing capabilities to optimize production processes, thereby enhancing its competitive positioning in the market.The business tactics employed by these companies include localizing manufacturing and optimizing supply chains to enhance operational efficiency. The market structure appears moderately fragmented, with several players vying for market share. However, the collective influence of major companies like BASF SE (Germany) and Johnson Matthey PLC (United Kingdom) suggests a trend towards consolidation, as these firms seek to leverage their technological expertise and market reach to gain a competitive edge.

In September BASF SE (Germany) announced a strategic partnership with a leading automotive manufacturer to develop next-generation emission control technologies. This collaboration is expected to enhance BASF's product portfolio and strengthen its position in the market, particularly as automotive manufacturers increasingly seek to comply with stringent emission regulations. The partnership underscores the importance of innovation in maintaining competitive advantage in a rapidly evolving market.

In October Johnson Matthey PLC (United Kingdom) unveiled a new line of catalysts designed specifically for electric vehicles (EVs). This strategic move reflects the company's commitment to sustainability and its recognition of the growing demand for cleaner technologies. By diversifying its product offerings to include solutions for EVs, Johnson Matthey is positioning itself as a leader in the transition towards greener transportation solutions, which could significantly enhance its market share.

In August Tenneco Inc. (US) completed the acquisition of a smaller catalyst manufacturer, thereby expanding its technological capabilities and product range. This acquisition is likely to bolster Tenneco's competitive position by enabling it to offer a more comprehensive suite of emission control solutions. The integration of advanced technologies from the acquired firm may also enhance Tenneco's innovation potential, allowing it to respond more effectively to market demands.

As of November current trends in the mobile emission-catalysts market indicate a strong focus on digitalization, sustainability, and the integration of artificial intelligence (AI) in product development. Strategic alliances are increasingly shaping the competitive landscape, as companies recognize the need for collaboration to drive innovation. Looking ahead, it appears that competitive differentiation will evolve from traditional price-based competition to a focus on technological advancements, supply chain reliability, and sustainable practices. This shift may redefine market dynamics, compelling companies to invest in R&D and forge strategic partnerships to remain competitive.