Increased Defense Spending

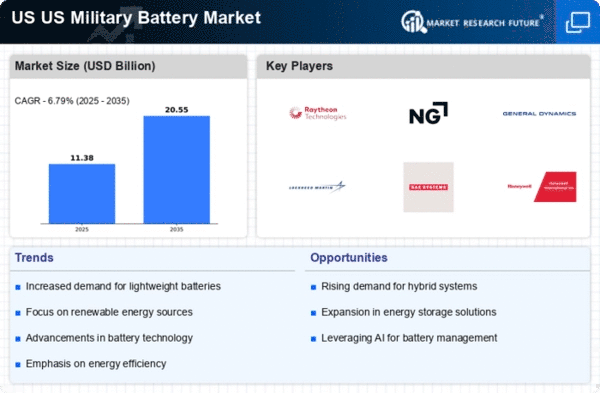

The US Military Battery Market is experiencing growth due to increased defense spending by the federal government. In recent years, the US has allocated substantial budgets to enhance military capabilities, which includes investments in advanced battery technologies. For instance, the Department of Defense has earmarked billions for modernization programs, which encompass the development of high-performance batteries for various applications, including unmanned systems and portable power solutions. This trend indicates a strong commitment to ensuring that military personnel have access to reliable and efficient power sources, thereby driving demand within the US Military Battery Market.

Demand for Portable Power Solutions

The US Military Battery Market is witnessing a surge in demand for portable power solutions. As military operations become increasingly mobile and decentralized, the need for lightweight and efficient battery systems has become paramount. The US military is actively seeking batteries that can support a range of applications, from personal equipment to larger systems like drones and vehicles. According to recent estimates, the market for portable military batteries is projected to grow significantly, driven by the need for enhanced operational efficiency and reduced logistical burdens. This demand is likely to propel innovation and investment in the US Military Battery Market.

Focus on Energy Density and Performance

The US Military Battery Market is characterized by a strong focus on energy density and performance. As military operations require batteries that can deliver high energy output while maintaining a compact size, manufacturers are investing in research and development to create advanced battery chemistries. Lithium-ion and solid-state batteries are at the forefront of this innovation, offering improved energy density and longer life cycles. The US military's emphasis on operational readiness and efficiency necessitates the adoption of these high-performance batteries, which are expected to dominate the market in the coming years. This focus on performance is likely to shape the future landscape of the US Military Battery Market.

Integration of Renewable Energy Sources

The US Military Battery Market is increasingly integrating renewable energy sources into its operations. The military is exploring ways to harness solar and wind energy to power its installations and equipment, which necessitates the development of advanced battery storage solutions. This integration not only enhances energy security but also aligns with broader sustainability goals. The US military's commitment to reducing its carbon footprint is driving investments in hybrid systems that combine traditional batteries with renewable energy sources. This trend is expected to create new opportunities within the US Military Battery Market, as the demand for innovative energy storage solutions continues to rise.

Emerging Threats and Technological Advancements

The US Military Battery Market is influenced by emerging threats and the need for technological advancements. As geopolitical tensions rise, the military is compelled to enhance its operational capabilities, which includes the development of advanced battery systems. The integration of cutting-edge technologies, such as artificial intelligence and smart sensors, into battery management systems is becoming increasingly prevalent. These advancements not only improve battery performance but also enhance the overall efficiency of military operations. The US military's focus on staying ahead of potential adversaries is likely to drive further innovation and investment in the US Military Battery Market.