Growth in Marine Automation

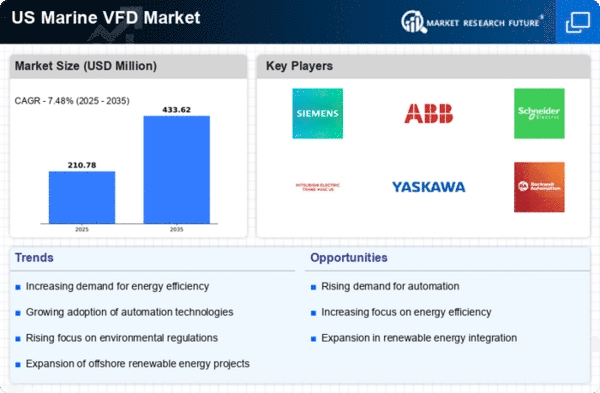

The marine vfd market is significantly influenced by the ongoing growth in marine automation. As vessels become more sophisticated, the demand for automated systems that enhance operational efficiency is on the rise. VFDs play a crucial role in this automation by enabling precise control over propulsion and auxiliary systems. The market for marine automation is projected to grow at a CAGR of approximately 10% over the next five years, indicating a robust opportunity for VFD manufacturers. This growth is driven by the need for improved safety, reduced crew workload, and enhanced operational reliability. As automation continues to evolve, the marine vfd market is likely to expand in tandem, providing innovative solutions to meet the demands of modern maritime operations.

Rising Environmental Regulations

The marine vfd market is increasingly shaped by stringent environmental regulations aimed at reducing emissions and promoting sustainable practices. Regulatory bodies are imposing limits on greenhouse gas emissions and other pollutants, compelling marine operators to adopt cleaner technologies. VFDs contribute to this transition by optimizing motor performance and reducing energy consumption, which in turn lowers emissions. The implementation of VFDs can lead to a reduction in CO2 emissions by as much as 20%, aligning with regulatory goals. As compliance with these regulations becomes mandatory, the marine vfd market is poised for growth, as operators seek solutions that not only meet legal requirements but also enhance operational efficiency.

Expansion of Renewable Energy Sources

The marine vfd market is benefiting from the expansion of renewable energy sources within the maritime sector. As the industry shifts towards greener alternatives, the integration of VFDs in renewable energy applications, such as wind and solar-powered vessels, is becoming more prevalent. These drives facilitate the efficient operation of electric motors that are essential for harnessing renewable energy. The market for renewable energy in marine applications is expected to grow significantly, with investments projected to reach $10 billion by 2030. This shift not only supports sustainability goals but also drives innovation in the marine vfd market, as manufacturers develop solutions tailored to the unique requirements of renewable energy systems.

Increased Demand for Energy Efficiency

The marine vfd market is experiencing a notable surge in demand for energy-efficient solutions. As operators seek to reduce operational costs, the integration of variable frequency drives (VFDs) has become increasingly prevalent. These systems allow for precise control of motor speeds, leading to significant energy savings. Reports indicate that energy consumption in marine applications can be reduced by up to 30% with the implementation of VFDs. This trend is further fueled by rising fuel prices and the need for sustainable practices within the marine industry. Consequently, the push for energy efficiency is a critical driver in the marine vfd market, as stakeholders prioritize technologies that enhance performance while minimizing environmental impact.

Technological Innovations in VFD Design

The marine vfd market is witnessing a wave of technological innovations that enhance the performance and reliability of VFDs. Advances in semiconductor technology, control algorithms, and digital communication are enabling the development of more efficient and compact VFD systems. These innovations allow for better integration with existing marine systems, improving overall operational efficiency. The introduction of smart VFDs, which offer real-time monitoring and diagnostics, is particularly noteworthy. Such features can lead to reduced maintenance costs and increased system uptime. As these technological advancements continue to emerge, they are likely to drive the marine vfd market forward, providing operators with cutting-edge solutions that meet the evolving demands of the maritime industry.