Emergence of New Business Models

The leo satellite market is evolving with the emergence of new business models that capitalize on satellite capabilities. Companies are increasingly exploring subscription-based services, data analytics, and satellite-as-a-service offerings. This shift allows businesses to access satellite data without the need for significant upfront investments. For example, firms can now subscribe to satellite imagery services for agricultural monitoring or disaster response, thereby enhancing operational efficiency. This trend is likely to attract a diverse range of industries, from agriculture to logistics, further driving the growth of the leo satellite market. Analysts suggest that these innovative business models could account for a substantial portion of the market's revenue by 2027.

Increased Government Initiatives

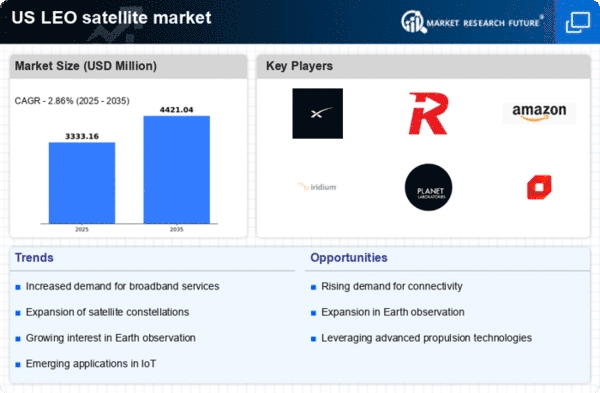

The leo satellite market is benefiting from increased government initiatives aimed at enhancing national security and technological leadership. The US government has recognized the strategic importance of satellite technology and is investing heavily in developing its capabilities. Programs such as the National Defense Space Architecture are designed to bolster satellite communications and surveillance. This governmental support is likely to stimulate growth in the leo satellite market, as private companies collaborate with government agencies to develop innovative solutions. The infusion of public funding could lead to a market expansion, with projections indicating a compound annual growth rate (CAGR) of around 15% over the next five years.

Rising Interest in Earth Observation

The leo satellite market is experiencing a rising interest in Earth observation applications, driven by the need for environmental monitoring and disaster management. As climate change and natural disasters become more prevalent, the demand for accurate and timely data has intensified. Leo satellites are uniquely positioned to provide high-resolution imagery and real-time data, which are crucial for tracking environmental changes and responding to emergencies. The market for Earth observation data is projected to reach $5 billion by 2026, indicating a robust growth trajectory. This increasing focus on sustainability and data-driven decision-making is likely to propel the leo satellite market forward, as stakeholders seek to leverage satellite technology for better environmental stewardship.

Growing Demand for High-Speed Internet

The leo satellite market is witnessing a growing demand for high-speed internet services, particularly in underserved and rural areas. With the increasing reliance on digital connectivity, the need for reliable internet access has become paramount. According to recent estimates, around 30% of the US population still lacks access to high-speed broadband. Leo satellites offer a viable solution to bridge this digital divide by providing low-latency internet services. Companies like SpaceX and OneWeb are actively deploying constellations of satellites to meet this demand, which is expected to drive significant growth in the leo satellite market. The potential for expanding internet access could lead to a market valuation exceeding $30 billion by 2030.

Technological Advancements in Satellite Design

The leo satellite market is experiencing a surge in technological advancements that enhance satellite design and functionality. Innovations in miniaturization and materials science have led to the development of smaller, lighter satellites that can be launched at a fraction of the cost. For instance, the average cost of launching a satellite has decreased by approximately 50% over the past decade, making it more accessible for various industries. These advancements not only improve the performance of satellites but also expand their applications, from telecommunications to Earth observation. As a result, the leo satellite market is likely to see increased demand from sectors seeking to leverage these technologies for improved data collection and communication capabilities.