Rising Demand for Connectivity

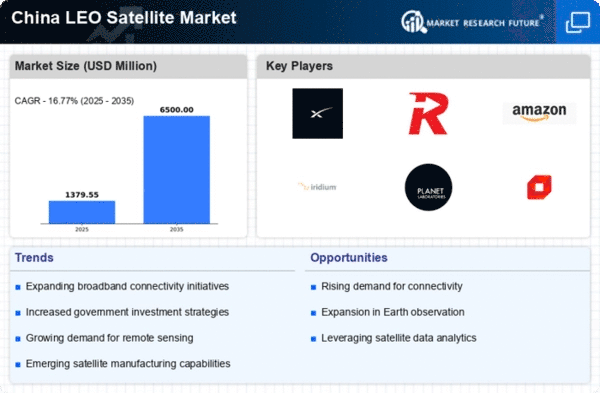

The demand for high-speed internet connectivity in remote and underserved regions of China is driving growth in the leo satellite market. As urban areas become increasingly saturated with internet services, rural regions are still lagging behind. The leo satellite market is poised to address this gap by providing reliable internet access to these areas. In 2025, it is estimated that around 30% of the population in rural China lacks adequate internet connectivity. This presents a substantial opportunity for leo satellite operators to expand their services. The ability to deliver broadband services via satellites is expected to enhance educational and economic opportunities in these regions, thereby propelling the leo satellite market forward.

Government Initiatives and Support

The Chinese government has been actively promoting the development of the leo satellite market through various initiatives and policies. This support includes funding for research and development, as well as incentives for private companies to invest in satellite technology. In 2025, the government allocated approximately $1 billion to enhance satellite communication capabilities, which is expected to boost the leo satellite market significantly. Furthermore, the establishment of regulatory frameworks aims to streamline satellite launches and operations, thereby encouraging more players to enter the market. This proactive approach by the government is likely to foster innovation and competition within the leo satellite market, ultimately leading to improved services and reduced costs for consumers.

Growing Interest in Earth Observation

The leo satellite market is experiencing a surge in interest for earth observation applications, driven by the need for data in various sectors such as agriculture, urban planning, and disaster management. In China, the government has recognized the importance of satellite data for monitoring environmental changes and managing natural resources. By 2025, it is projected that the demand for earth observation data will grow by approximately 25%, creating new opportunities for leo satellite operators. This trend indicates a shift towards utilizing satellite technology for practical applications, thereby expanding the scope of the leo satellite market and attracting investments from both public and private sectors.

International Collaboration and Partnerships

International collaboration is becoming increasingly vital for the growth of the leo satellite market. Chinese companies are forming partnerships with foreign entities to leverage expertise and share resources. These collaborations often focus on joint satellite missions, technology sharing, and co-development of satellite systems. In 2025, it is anticipated that such partnerships will account for nearly 15% of the total investments in the leo satellite market. This trend not only enhances technological capabilities but also facilitates access to new markets and customer bases. As a result, international collaboration is likely to play a pivotal role in shaping the future landscape of the leo satellite market in China.

Technological Advancements in Satellite Design

Innovations in satellite technology are playing a crucial role in shaping the leo satellite market. Advances in miniaturization, propulsion systems, and communication technologies have led to the development of more efficient and cost-effective satellites. For instance, the introduction of small satellite constellations has reduced launch costs by up to 50%, making it more feasible for companies to deploy leo satellites. These technological advancements not only lower operational costs but also enhance the performance and reliability of satellite services. As a result, the leo satellite market is likely to witness increased competition and a wider array of services, catering to diverse consumer needs in China.