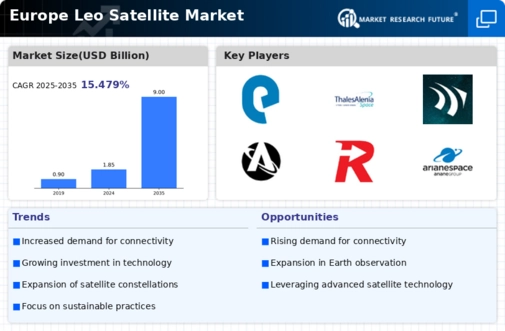

Growing Demand for Connectivity

The increasing demand for high-speed internet and connectivity solutions across Europe is a primary driver for the leo satellite market. As urbanization and digitalization continue to rise, the need for reliable internet access in remote and rural areas becomes more pressing. According to recent estimates, approximately 30% of the European population still lacks adequate internet access, highlighting a significant market opportunity. Leo satellites can provide low-latency, high-bandwidth services that traditional terrestrial networks struggle to deliver. This demand is further fueled by the rise of IoT devices, which require constant connectivity. Consequently, the leo satellite market is poised to expand as service providers seek to bridge the digital divide and meet the growing expectations of consumers and businesses alike.

Government Initiatives and Funding

Government initiatives aimed at enhancing satellite communication capabilities are significantly influencing the leo satellite market in Europe. Various European nations have recognized the strategic importance of satellite technology for national security, economic growth, and technological advancement. For instance, the European Space Agency (ESA) has allocated substantial funding for satellite projects, with budgets reaching over €1 billion annually. These investments are designed to foster innovation and support the development of new satellite technologies. Additionally, public-private partnerships are emerging, allowing private companies to collaborate with government entities to accelerate the deployment of leo satellite systems. This synergy is likely to enhance the competitiveness of the European satellite industry and stimulate further growth in the leo satellite market.

Rising Interest in Earth Observation

The increasing interest in Earth observation applications is emerging as a crucial driver for the leo satellite market. Governments, research institutions, and private companies are recognizing the value of satellite data for various applications, including climate monitoring, agriculture, and disaster management. The European Union's Copernicus program, which aims to provide high-quality environmental data, has significantly boosted the demand for satellite imagery and analytics. The market for Earth observation data is projected to grow at a CAGR of 15% over the next five years, indicating a robust opportunity for leo satellite operators. This growing interest in data-driven decision-making is likely to propel the leo satellite market forward, as more entities seek to leverage satellite capabilities for sustainable development and resource management.

Competitive Landscape and Market Entry

The competitive landscape of the leo satellite market in Europe is becoming increasingly dynamic, with new entrants and established players vying for market share. The entry of innovative startups, often backed by venture capital, is intensifying competition and driving technological advancements. These companies are exploring niche markets, such as satellite-based internet services and specialized data analytics, which could disrupt traditional business models. Moreover, established aerospace companies are expanding their portfolios to include leo satellite services, further intensifying competition. This competitive environment is likely to lead to price reductions and improved service offerings, benefiting consumers and businesses alike. As the market evolves, strategic partnerships and collaborations may emerge, shaping the future of the leo satellite market.

Technological Innovations in Satellite Design

Technological advancements in satellite design and manufacturing are driving the evolution of the leo satellite market. Innovations such as miniaturization, improved propulsion systems, and enhanced payload capabilities are enabling the deployment of more efficient and cost-effective satellites. For example, the development of small satellites, or CubeSats, has reduced launch costs significantly, with prices dropping to as low as $5,000 per kg. This trend allows for the deployment of larger constellations of satellites, which can provide comprehensive coverage and improved service quality. Furthermore, advancements in materials science and manufacturing techniques are enhancing satellite durability and performance. As these technologies continue to evolve, they are likely to attract more investment and interest in the leo satellite market, fostering a competitive landscape.