Aging Population

The demographic shift towards an aging population in the US is influencing the hemostats market significantly. Older adults are more susceptible to chronic conditions that often necessitate surgical interventions, thereby increasing the demand for hemostatic agents. By 2025, it is estimated that over 20% of the US population will be aged 65 and older, leading to a higher incidence of surgeries such as orthopedic and cardiovascular procedures. This demographic trend suggests a sustained demand for effective hemostatic solutions, as healthcare providers aim to address the unique needs of this population. The hemostats market is thus positioned to benefit from this growing segment, as innovations in product formulations cater to the specific requirements of older patients.

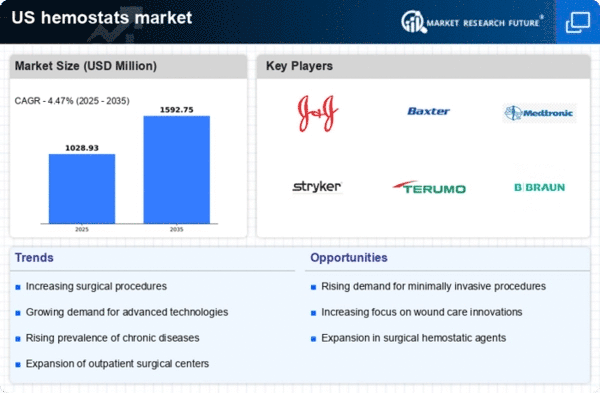

Increasing Surgical Procedures

The rising number of surgical procedures in the US is a primary driver for the hemostats market. As healthcare providers increasingly adopt minimally invasive techniques, the demand for effective hemostatic agents has surged. In 2025, the surgical volume is projected to reach approximately 50 million procedures, which could lead to a significant increase in the utilization of hemostatic products. This trend is further supported by advancements in surgical technologies, which often require precise hemostatic solutions to manage bleeding effectively. Consequently, the hemostats market is likely to experience robust growth as hospitals and surgical centers seek to enhance patient outcomes and reduce complications associated with excessive bleeding during operations.

Rising Awareness of Blood Loss Management

There is a growing awareness regarding the importance of effective blood loss management in surgical settings, which is positively impacting the hemostats market. Healthcare professionals are increasingly recognizing the need for reliable hemostatic agents to minimize complications associated with excessive bleeding. Educational initiatives and training programs aimed at improving knowledge about blood management strategies are gaining traction. This heightened awareness is expected to drive demand for hemostatic products, as hospitals and surgical centers seek to implement best practices in patient care. By 2025, the hemostats market may see a notable increase in product adoption, as healthcare providers strive to enhance surgical outcomes and reduce the risks associated with blood loss.

Regulatory Support for Innovative Solutions

Regulatory support for innovative hemostatic solutions is emerging as a key driver for the hemostats market. The US Food and Drug Administration (FDA) has been actively streamlining the approval process for new hemostatic agents, encouraging the development of novel products. This regulatory environment fosters innovation and allows manufacturers to bring advanced hemostatic solutions to market more efficiently. As a result, the hemostats market is likely to benefit from an influx of new products that address specific clinical needs. By 2025, the combination of regulatory support and market demand for innovative hemostatic agents may lead to a more competitive landscape, ultimately enhancing patient care in surgical settings.

Technological Innovations in Hemostatic Products

Technological innovations are playing a crucial role in shaping the hemostats market. The introduction of advanced hemostatic agents, such as those utilizing nanotechnology and bioengineered materials, is enhancing the efficacy and safety of these products. In 2025, the market is expected to witness a surge in the adoption of these innovative solutions, which offer improved performance in controlling bleeding. Furthermore, the integration of smart technologies in hemostatic products may provide real-time monitoring of bleeding, thereby improving surgical outcomes. As healthcare providers increasingly prioritize patient safety and efficiency, the hemostats market is likely to expand, driven by the demand for cutting-edge solutions that address the complexities of modern surgical practices.