Growth of Retail Fuel Outlets

The growth of retail fuel outlets is a significant driver for the fuel pumps market. As the number of gas stations and convenience stores increases, the demand for fuel pumps is expected to rise correspondingly. This expansion is fueled by changing consumer behaviors, with more individuals opting for convenience and accessibility in fuel purchasing. The fuel pumps market is poised to benefit from this trend, as retailers invest in modernizing their fuel dispensing systems to attract customers. Projections indicate that the number of retail fuel outlets could increase by 15% by 2027, further stimulating demand for advanced fuel pump solutions.

Rising Demand for Fuel Efficiency

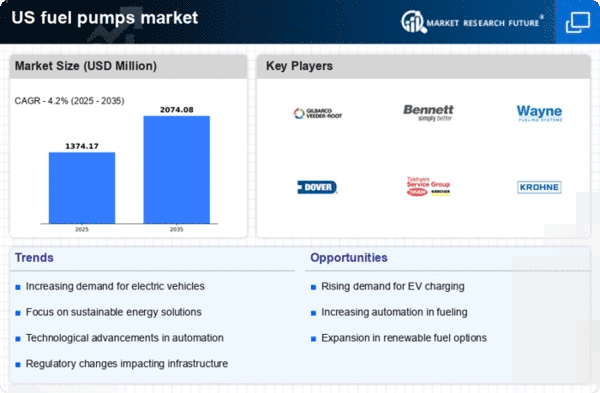

The fuel pumps market is experiencing a notable increase in demand for fuel-efficient solutions. As consumers and businesses alike seek to reduce operational costs, the emphasis on fuel efficiency has intensified. This trend is particularly evident in the transportation sector, where fuel pumps that optimize fuel delivery are becoming essential. According to recent data, the fuel pumps market is projected to grow at a CAGR of approximately 4.5% through 2026, driven by this demand. Additionally, advancements in pump technology that enhance fuel efficiency are likely to further propel market growth. The fuel pumps market is thus adapting to these evolving consumer preferences, leading to innovations that prioritize efficiency and sustainability.

Expansion of Electric Vehicle Infrastructure

The ongoing expansion of electric vehicle (EV) infrastructure is influencing the fuel pumps market in the US. As the number of EVs on the road increases, traditional fuel pumps are being re-evaluated to accommodate changing consumer needs. While the focus is shifting towards electric charging stations, the fuel pumps market must adapt by integrating hybrid solutions that cater to both conventional and electric vehicles. This transition may lead to a diversification of product offerings within the market. Furthermore, the investment in EV infrastructure is expected to reach $7.5 billion by 2025, indicating a significant shift in the automotive landscape that could reshape the fuel pumps market.

Increased Focus on Environmental Regulations

The fuel pumps market is significantly impacted by the heightened focus on environmental regulations. As regulatory bodies implement stricter emissions standards, fuel pumps must comply with these evolving requirements. This compliance not only affects the design and functionality of fuel pumps but also drives innovation within the industry. Companies are investing in research and development to create pumps that minimize environmental impact while maintaining performance. The fuel pumps market is thus witnessing a shift towards more sustainable practices, with an estimated 30% of new products expected to meet advanced environmental standards by 2027. This trend underscores the importance of regulatory compliance in shaping market dynamics.

Technological Integration in Fuel Dispensing

The integration of advanced technologies in fuel dispensing systems is reshaping the fuel pumps market. Innovations such as smart pumps equipped with IoT capabilities are enhancing operational efficiency and customer experience. These technologies allow for real-time monitoring and data analytics, enabling fuel retailers to optimize their operations. The fuel pumps market is likely to see a surge in demand for these smart solutions, as they offer improved accuracy and convenience. Market analysis suggests that the adoption of technology-driven fuel pumps could increase by 25% over the next few years, reflecting a broader trend towards digitization in the sector.