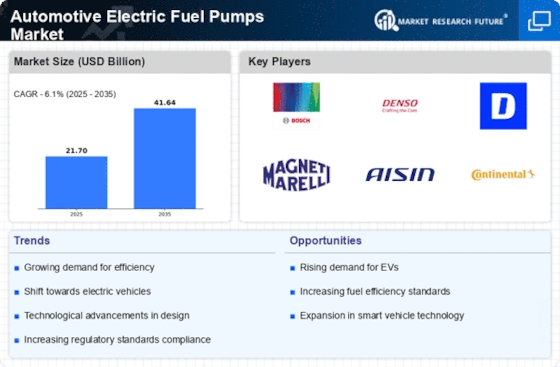

Rising Demand for Fuel Efficiency

The Automotive Electric Fuel Pumps Market is experiencing a notable increase in demand for fuel-efficient vehicles. As consumers become more environmentally conscious, manufacturers are compelled to innovate and produce vehicles that consume less fuel. This trend is further supported by regulatory frameworks that promote fuel efficiency standards. In 2025, the average fuel economy of new vehicles is projected to reach approximately 25 miles per gallon, which is a significant improvement compared to previous years. Consequently, automotive manufacturers are increasingly integrating electric fuel pumps into their designs to enhance performance and efficiency, thereby driving growth in the Automotive Electric Fuel Pumps Market.

Increase in Electric Vehicle Adoption

The Automotive Electric Fuel Pumps Market is significantly influenced by the rising adoption of electric vehicles (EVs). As more consumers opt for EVs, the demand for electric fuel pumps is expected to grow, albeit in a different context compared to traditional vehicles. The transition towards electric mobility is prompting manufacturers to rethink fuel delivery systems, leading to innovations that cater specifically to electric drivetrains. By 2025, it is anticipated that electric vehicles will account for over 20% of total vehicle sales, thereby creating new opportunities within the Automotive Electric Fuel Pumps Market.

Consumer Preference for Advanced Features

Consumer preferences are shifting towards vehicles equipped with advanced features, which is impacting the Automotive Electric Fuel Pumps Market. Features such as improved fuel efficiency, enhanced performance, and reduced noise levels are becoming increasingly desirable among buyers. This trend is prompting manufacturers to invest in the development of electric fuel pumps that not only meet these expectations but also provide a competitive edge in the market. As consumers continue to prioritize technology and performance, the demand for innovative electric fuel pumps is expected to rise, further stimulating growth in the Automotive Electric Fuel Pumps Market.

Regulatory Support for Emission Reductions

Regulatory frameworks aimed at reducing emissions are driving changes in the Automotive Electric Fuel Pumps Market. Governments worldwide are implementing stricter emission standards, which compel manufacturers to adopt cleaner technologies. This regulatory push is fostering the development of electric fuel pumps that align with these standards, thereby enhancing vehicle performance while minimizing environmental impact. As a result, the market is likely to see a surge in demand for electric fuel pumps that meet these evolving regulations, with projections indicating a steady growth trajectory in the coming years.

Technological Innovations in Fuel Pump Design

Technological advancements play a crucial role in shaping the Automotive Electric Fuel Pumps Market. Innovations such as variable speed pumps and advanced materials are enhancing the performance and reliability of electric fuel pumps. These developments not only improve fuel delivery but also contribute to the overall efficiency of the vehicle. For instance, the introduction of smart fuel pumps that can adjust their operation based on real-time data is becoming more prevalent. This shift towards sophisticated technology is expected to propel the market forward, with estimates suggesting a compound annual growth rate of around 5% in the coming years.