Rising Health Consciousness

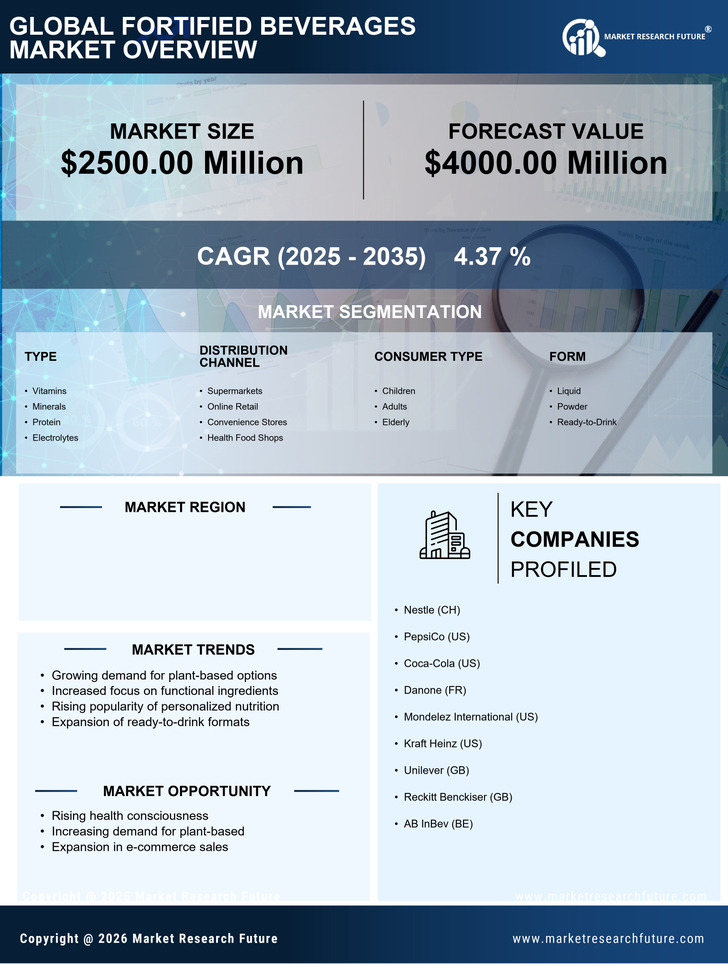

The fortified beverages market is experiencing a notable surge in demand driven by an increasing awareness of health and wellness among consumers. As individuals become more health-conscious, they actively seek products that offer nutritional benefits. This trend is particularly evident in the US, where a significant % of the population prioritizes functional beverages that provide essential vitamins and minerals. According to recent data, the market for fortified beverages is projected to grow at a CAGR of approximately 8% over the next five years. This growth is indicative of a broader shift towards preventive health measures, with consumers opting for beverages that enhance their overall well-being. The fortified beverages market is thus positioned to capitalize on this trend, as manufacturers innovate to meet the evolving preferences of health-oriented consumers.

Increased Demand for Convenience

The fast-paced lifestyle of consumers in the US has led to a heightened demand for convenient and ready-to-drink options, significantly impacting the fortified beverages market. Busy individuals are increasingly looking for on-the-go solutions that provide nutritional value without compromising on taste. This shift is reflected in the growing popularity of fortified drinks that are easy to consume, such as ready-to-drink smoothies and protein shakes. Recent statistics indicate that the convenience segment within the fortified beverages market is expanding rapidly, with sales expected to rise by over 10% in the coming years. As a result, manufacturers are focusing on developing products that cater to this need for convenience, thereby driving growth within the fortified beverages market.

Shift Towards Plant-Based Options

The fortified beverages market is experiencing a notable shift towards plant-based options, driven by changing consumer preferences and dietary trends. As more individuals adopt vegetarian and vegan lifestyles, there is a growing demand for fortified beverages that align with these dietary choices. This trend is particularly pronounced in the US, where plant-based diets are gaining traction. Recent market analysis suggests that the plant-based segment within the fortified beverages market is expected to grow by approximately 9% annually. This growth is indicative of a broader movement towards sustainable and ethical consumption, prompting manufacturers to innovate and develop new plant-based fortified beverages. The fortified beverages market is thus adapting to these changes, ensuring that they meet the needs of a diverse consumer base.

Growing Interest in Functional Ingredients

The fortified beverages market is witnessing a significant transformation as consumers show a growing interest in functional ingredients that offer specific health benefits. Ingredients such as probiotics, antioxidants, and adaptogens are becoming increasingly popular among health-conscious consumers in the US. This trend is supported by research indicating that beverages containing these functional ingredients can enhance immunity, improve digestion, and reduce stress. The fortified beverages market is responding to this demand by incorporating innovative ingredients into their formulations. As a result, the market is projected to see a substantial increase in the introduction of new products featuring these functional components, potentially leading to a market growth rate of around 7% over the next few years.

Regulatory Support for Nutritional Products

The fortified beverages market is benefiting from increased regulatory support aimed at promoting nutritional products. In the US, government initiatives and guidelines are encouraging the consumption of fortified foods and beverages to combat nutritional deficiencies. This regulatory environment is fostering innovation within the fortified beverages market, as companies are motivated to develop products that comply with health standards while addressing consumer needs. Recent data indicates that the market is likely to expand as more consumers become aware of the benefits of fortified beverages, supported by government campaigns promoting healthy eating. This regulatory backing is expected to enhance consumer trust and drive sales, contributing to the overall growth of the fortified beverages market.