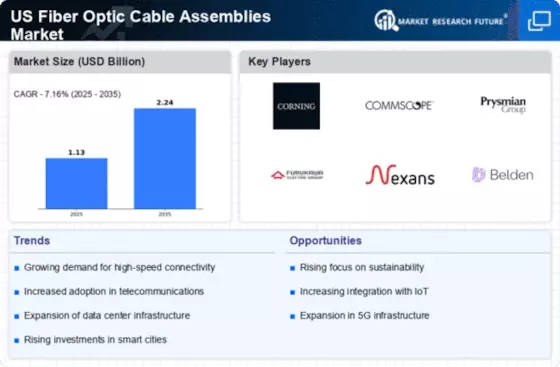

Increased Focus on Data Centers

The growing emphasis on data center expansion is driving demand within the US Fiber Optic Cable Assemblies Market. As organizations increasingly migrate to cloud-based solutions, the need for efficient and high-capacity data centers has surged. Fiber optic cable assemblies are integral to data center operations, facilitating high-speed data transfer and connectivity. Recent reports indicate that the data center market in the US is projected to grow at a CAGR of 8% through 2026, further propelling the demand for fiber optic solutions. This trend underscores the importance of the US Fiber Optic Cable Assemblies Market in supporting the infrastructure necessary for modern data management and storage solutions.

Growing Adoption of 5G Technology

The rollout of 5G technology is a pivotal driver for the US Fiber Optic Cable Assemblies Market. As telecommunications companies expand their 5G networks, the demand for high-performance fiber optic cable assemblies is expected to rise significantly. Fiber optics are essential for backhauling data from 5G cell sites to core networks, ensuring that the high-speed capabilities of 5G are fully realized. Industry analysts estimate that the 5G infrastructure investment in the US could exceed USD 100 billion by 2025, creating substantial opportunities for fiber optic manufacturers. This trend highlights the critical role of the US Fiber Optic Cable Assemblies Market in supporting the next generation of wireless communication technologies.

Rising Demand for High-Speed Connectivity

The US Fiber Optic Cable Assemblies Market is experiencing a notable surge in demand for high-speed connectivity solutions. As businesses and consumers increasingly rely on fast internet services, the need for robust fiber optic cable assemblies has become paramount. According to recent data, the demand for fiber optic connections is projected to grow at a compound annual growth rate (CAGR) of approximately 10% over the next five years. This growth is driven by the proliferation of cloud computing, streaming services, and the Internet of Things (IoT), all of which necessitate high bandwidth and low latency. Consequently, manufacturers in the US Fiber Optic Cable Assemblies Market are focusing on developing innovative products that meet these requirements, thereby enhancing their competitive edge in a rapidly evolving landscape.

Advancements in Manufacturing Technologies

Technological advancements in manufacturing processes are significantly influencing the US Fiber Optic Cable Assemblies Market. Innovations such as automated production lines and advanced materials are enabling manufacturers to produce high-quality fiber optic assemblies more efficiently. For instance, the introduction of precision molding techniques has improved the consistency and reliability of fiber optic connectors. Furthermore, the integration of smart manufacturing technologies, including IoT and artificial intelligence, is streamlining operations and reducing production costs. As a result, companies are better positioned to meet the increasing demand for fiber optic solutions, which is expected to reach a market value of over USD 5 billion by 2027. This trend underscores the importance of continuous investment in manufacturing technologies within the US Fiber Optic Cable Assemblies Market.

Government Initiatives for Broadband Expansion

Government initiatives aimed at expanding broadband access are playing a crucial role in shaping the US Fiber Optic Cable Assemblies Market. Federal and state programs are increasingly focused on bridging the digital divide, particularly in rural and underserved areas. For example, the Federal Communications Commission (FCC) has allocated significant funding to support the deployment of fiber optic infrastructure. This initiative is expected to drive demand for fiber optic cable assemblies, as service providers seek to enhance their networks. The US Fiber Optic Cable Assemblies Market stands to benefit from these initiatives, with projections indicating a potential increase in market size by 15% over the next few years. Such government support not only stimulates market growth but also encourages private sector investment in fiber optic technologies.