Focus on Cybersecurity

The increasing focus on cybersecurity within the US Fiber Optic Cable For Military Aerospace Market is a significant driver of growth. As military operations become increasingly reliant on digital communication, the need for secure and reliable data transmission has never been more critical. Fiber optic cables are inherently more secure than traditional copper cables, as they are less susceptible to interception and hacking. The US military has recognized this advantage and is actively investing in fiber optic infrastructure to safeguard sensitive information. In recent years, initiatives aimed at enhancing cybersecurity measures have led to increased procurement of fiber optic solutions, thereby contributing to the overall expansion of the market.

Technological Advancements

Technological advancements play a crucial role in shaping the US Fiber Optic Cable For Military Aerospace Market. Innovations in fiber optic technology, such as the development of high-density cables and improved manufacturing processes, have made these cables more efficient and cost-effective. The introduction of new materials and designs has enhanced the performance of fiber optic systems, making them more suitable for military applications. For instance, the integration of fiber optics in avionics and communication systems has been shown to improve data transmission rates significantly. As the military seeks to leverage cutting-edge technology to maintain a strategic advantage, the demand for advanced fiber optic solutions is expected to rise, further propelling market growth.

Increased Military Spending

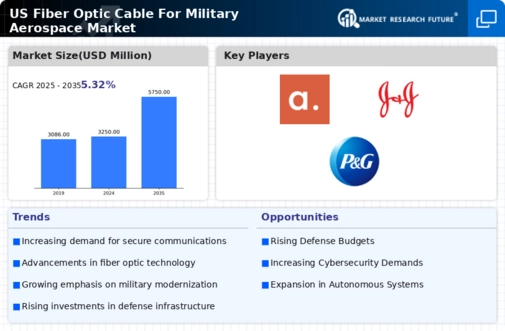

The US Fiber Optic Cable For Military Aerospace Market is experiencing a surge in demand due to increased military spending. The US government has allocated substantial budgets for defense and aerospace projects, which has led to a heightened focus on advanced communication systems. In fiscal year 2025, the Department of Defense reported a budget of over 800 billion USD, with a significant portion directed towards modernization efforts. This investment is likely to enhance the adoption of fiber optic cables, which offer superior bandwidth and reliability compared to traditional copper cables. As military operations become more complex, the need for robust communication infrastructure becomes paramount, thereby driving the growth of the fiber optic cable market in the military aerospace sector.

Regulatory Support and Standards

Regulatory support and the establishment of standards are vital drivers for the US Fiber Optic Cable For Military Aerospace Market. The US government has implemented various policies aimed at promoting the use of advanced communication technologies in defense applications. Agencies such as the Federal Aviation Administration (FAA) and the Department of Defense (DoD) have set forth guidelines that encourage the integration of fiber optic systems in military aircraft and infrastructure. These regulations not only ensure safety and reliability but also stimulate market growth by creating a favorable environment for investment in fiber optic technologies. As compliance with these standards becomes increasingly important, manufacturers are likely to focus on developing products that meet regulatory requirements, further driving the market.

Growing Demand for Data Transmission

The growing demand for high-speed data transmission is a key driver in the US Fiber Optic Cable For Military Aerospace Market. As military operations increasingly rely on real-time data sharing and communication, the need for high-capacity fiber optic networks has become essential. The US military's emphasis on network-centric warfare necessitates the deployment of advanced communication systems capable of handling vast amounts of data. Reports indicate that the demand for fiber optic cables in military applications is projected to grow at a compound annual growth rate of over 10% through 2026. This trend underscores the importance of fiber optics in enhancing operational efficiency and effectiveness in military aerospace.