Integration with Cloud Services

The integration of enterprise video solutions with cloud services is transforming the landscape of the enterprise video market. As businesses increasingly migrate to cloud-based infrastructures, the demand for scalable and flexible video solutions rises. Cloud integration allows for easier access, storage, and sharing of video content, facilitating collaboration across geographically dispersed teams. This trend is supported by data indicating that cloud-based video solutions are expected to account for over 60% of the market share by 2027. Such integration not only enhances operational efficiency but also drives innovation within the enterprise video market.

Focus on Data Analytics and Insights

The enterprise video market is witnessing a growing emphasis on data analytics and insights. Organizations are increasingly utilizing video analytics to measure engagement, track viewer behavior, and assess the effectiveness of video content. This data-driven approach enables companies to refine their video strategies and optimize content delivery. As businesses recognize the value of actionable insights, the demand for analytics tools within video platforms is likely to increase. Projections suggest that the analytics segment of the enterprise video market could grow by 25% over the next few years, highlighting the importance of data in shaping video communication strategies.

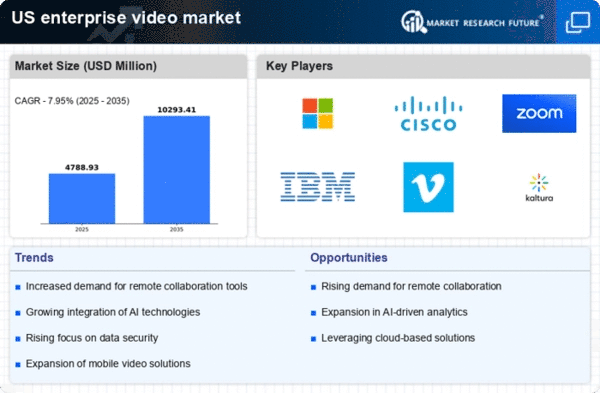

Growing Demand for Remote Collaboration

the enterprise video market is seeing a notable increase in demand for remote collaboration tools. As organizations increasingly adopt hybrid work models, the need for effective communication solutions has become paramount. Video conferencing platforms are now essential for facilitating meetings, training sessions, and team collaborations. According to recent data, the market for video conferencing solutions is projected to reach approximately $10 billion by 2026, reflecting a compound annual growth rate (CAGR) of around 15%. This growth indicates that businesses are prioritizing video communication as a core component of their operational strategies, thereby driving the enterprise video market forward.

Enhanced User Experience through Innovation

Innovation in user experience is a critical driver for the enterprise video market. Companies are investing in advanced technologies such as artificial intelligence and machine learning to enhance video quality and accessibility. Features like real-time transcription, automated meeting summaries, and seamless integration with existing software are becoming standard. This focus on user-centric design not only improves engagement but also increases productivity. As organizations recognize the value of intuitive interfaces, the enterprise video market is likely to see a significant uptick in adoption rates, with estimates suggesting a potential growth of 20% in user engagement metrics over the next few years.

Rising Importance of Training and Development

Training and development initiatives are increasingly relying on video content, which serves as a vital driver for the enterprise video market. Organizations are leveraging video for onboarding, skills training, and continuous education, recognizing its effectiveness in enhancing learning outcomes. The market for corporate training video solutions is expected to grow substantially, with projections indicating a value of $5 billion by 2025. This trend underscores the shift towards more engaging and flexible training methods, as companies aim to improve employee performance and retention. Consequently, the enterprise video market will benefit from this growing emphasis on educational video content.