Evolving Consumer Preferences

The electronic cash-register market is significantly influenced by evolving consumer preferences. Today's consumers prioritize speed, convenience, and personalization in their shopping experiences. As a result, retailers are increasingly investing in advanced electronic cash registers that offer features such as loyalty program integration and personalized promotions. This trend is evident in the growing adoption of point-of-sale systems that provide real-time data analytics, enabling retailers to tailor their offerings to meet customer demands. In 2025, it is estimated that 40% of retailers have implemented such systems, reflecting a shift towards more customer-centric approaches. Consequently, the electronic cash-register market is likely to expand as businesses adapt to these changing consumer behaviors.

Regulatory Compliance and Standards

The electronic cash-register market is also influenced by regulatory compliance and industry standards. Retailers are required to comply with various financial regulations, including those related to data security and transaction reporting. As these regulations become more stringent, the demand for electronic cash registers that meet compliance requirements is expected to rise. In 2025, approximately 25% of retailers reported investing in upgraded systems to ensure compliance with new regulations. This trend indicates a growing awareness among businesses of the importance of maintaining compliance to avoid penalties and enhance customer trust. Thus, the electronic cash-register market is likely to see increased demand for compliant solutions.

Technological Advancements in Retail

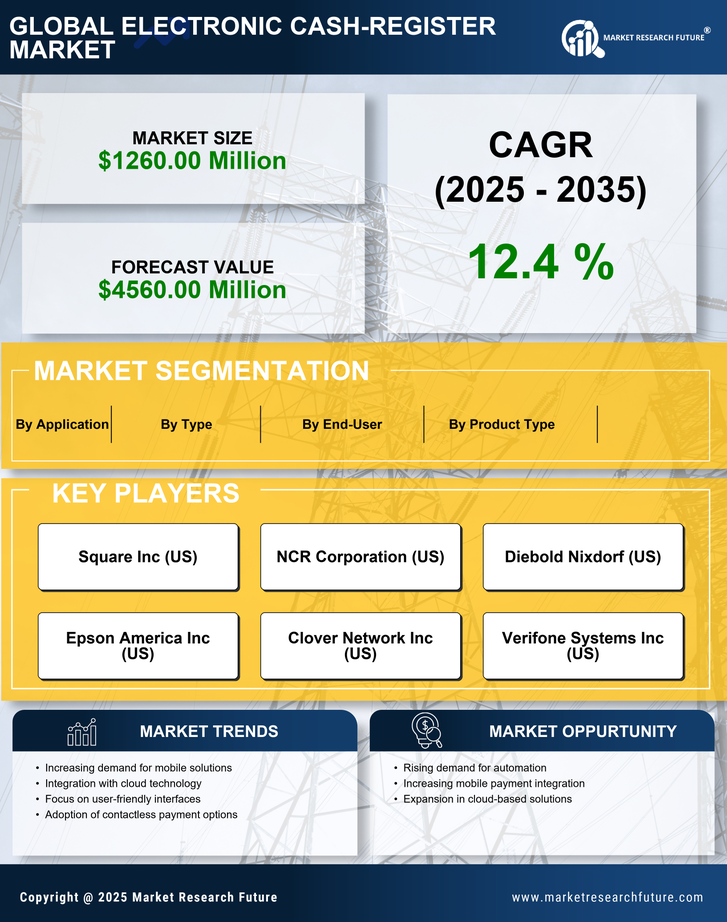

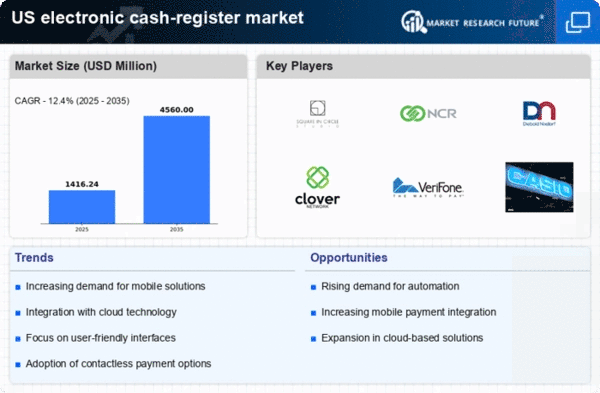

The electronic cash-register market is experiencing a surge due to rapid technological advancements in retail. Innovations such as touch-screen interfaces, integrated software solutions, and advanced analytics are transforming traditional cash registers into multifunctional devices. Retailers are increasingly adopting these technologies to enhance customer experience and streamline operations. According to recent data, the market for electronic cash registers is projected to grow at a CAGR of 6.5% from 2025 to 2030. This growth is driven by the need for efficient transaction processing and inventory management, which are critical in a competitive retail environment. As retailers seek to improve operational efficiency, the electronic cash-register market is likely to benefit from these technological trends, positioning itself as a vital component in modern retail strategies.

Rising Demand for Contactless Transactions

The electronic cash-register market is witnessing an increase in demand for contactless transactions. As consumers increasingly prefer quick and convenient payment methods, retailers are compelled to upgrade their cash registers to accommodate these preferences. The integration of Near Field Communication (NFC) technology into electronic cash registers allows for seamless transactions, enhancing customer satisfaction. Recent statistics indicate that contactless payments accounted for approximately 30% of all transactions in the retail sector in 2025. This shift towards contactless payment solutions is likely to drive the growth of the electronic cash-register market, as businesses strive to meet evolving consumer expectations and improve transaction efficiency.

Growth of E-commerce and Omnichannel Retailing

The electronic cash-register market is being propelled by the growth of e-commerce and omnichannel retailing strategies. As more consumers shop online, retailers are integrating their electronic cash registers with e-commerce platforms to provide a seamless shopping experience. This integration allows for real-time inventory management and unified customer data across channels. In 2025, it is estimated that 50% of retailers have adopted omnichannel strategies, reflecting a significant shift in how businesses operate. The electronic cash-register market is likely to benefit from this trend, as retailers seek to enhance their operational efficiency and customer engagement through integrated solutions.