Research Methodology on Cash Management System Market

1. Introduction:

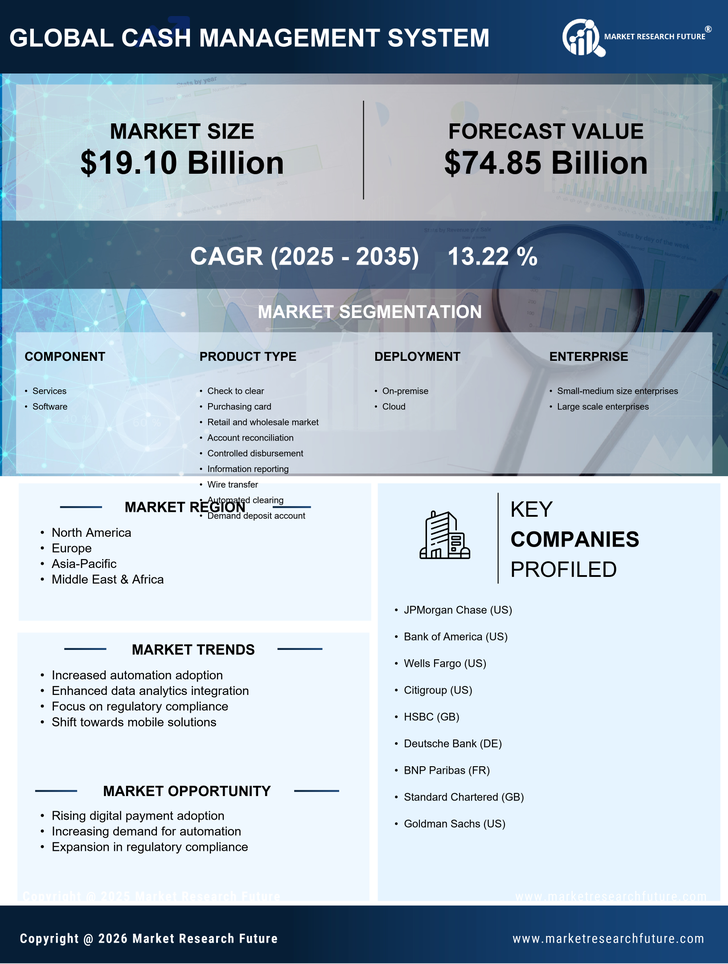

Market Research Future (MRFR) has initiated an in-depth study of the global cash management system market. The present research document provides a detailed understanding of the cash management system market, with an exhaustive analysis of the market size and market potential for the period of 2023 to 2030 (forecast period). The report aims to offer lucrative insights and attainable growth prospects of the cash management system market. The study further elaborates on the current trends, market opportunities, and driving forces in the cash management system market.

2. Research Objective:

The research objectives for this report on the cash management system market are:

- To analyze and forecast the market size of the cash management system market globally

- To offer an in-depth assessment of the market segments

- To provide a detailed analysis of macro- and micro-economic factors

- To evaluate the regional market profiles and changes

- To analyze the changes in demand patterns and pricing structure

- To offer an extensive analysis of the key players contributing to the market

- To provide a comprehensive analysis of the major dynamics surrounding the industry

3. Research Methodology:

MRFR’s data-driven approach is used to derive the market size, industry trends, market opportunity, and revenue estimates. For the cash management system market, MRFR has compiled primary and secondary data sources such as industry reports, press releases, annual reports, interviews, and newsletters. The data gathered from primary and secondary sources is further analyzed and processed to obtain qualitative and quantitative insights into the global cash management system market. Primary research is conducted through surveys and interviews with key opinion leaders from the cash management system market. Secondary research involves desk-top research techniques such as literature review.

4. Data Collection:

For the study of the cash management system market, MRFR has conducted a detailed analysis of the market size and market potential for the period of 2023 to 2030 (forecast period). The market sizing procedure involves analyzing historical data of various cash management systems and comparing them with the current market trends. This helps to derive the current market size and deduce future opportunities.

MRFR has adopted a methodical approach to studying the cash management system market. This involves a detailed market understanding of cash management systems - the types, complexities, and industry dynamics. Further, MRFR has conducted extensive primary and secondary research to compile the report. Primary research includes surveys and interviews with key opinion leaders, such as industry experts and business professionals. Secondary research includes sources such as industry reports, press releases, and annual reports.

4. Market Segmentation:

The global cash management system market has been segmented based on type, solution, application, and end user. By type, the market has been segmented into automated teller machines (ATMs), point-of-sale (POS) systems, cash-in-transit (CTI), and others. By solution, the market has been segmented into cash management solutions, cash flow management solutions, currency management solutions, and others. By application, the market has been segmented into banking, retail, healthcare, and others. By end user, the market has been segmented into retail, hospitality, BFSI, and others.

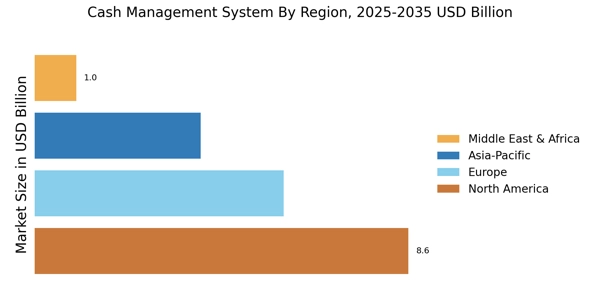

5. Regional Analysis:

The global cash management system market has been studied across five regions, namely, North America, Europe, Asia-Pacific (APAC), Middle East & Africa (MEA), and South America. North America is dominating the global cash management system market. The growth of the cash management system market in North America is due to the presence of leading IT companies, increasing adoption of cash management systems, massive investments in machine learning and artificial intelligence (AI) technology, implementation of cutting-edge technologies, and increasing focus on data analytics.

Europe is the second-largest market for cash management systems, after North America. The steady growth of the European cash management system market can be attributed to the introduction of innovative and advanced cash management systems, increasing government initiatives, and rising investments in research & development (R&D) activities.

Furthermore, the market in APAC is expected to witness growth at the highest CAGR during the forecast period. The growth in the APAC region is due to increasing demand for cash management systems in the banking and retail sectors, implementation of cash management systems by small and medium-sized enterprises (SMEs), and rising investments in digital technologies.

6. Competitive Analysis:

The competitive analysis section of the report provides a detailed analysis of the key players operating in the global cash management system market. The players have been studied based on their product offerings, business strategies, recent developments, and financials. The market potential of all the leading players has been extensively studied in the report and provides an adequate data set for risk analysis. Moreover, the players have been studied based on their respective strengths and weaknesses in the market.

The prominent players in the global cash management system market are BEAMEX AG (Switzerland), Tieto Oyj (Finland), CashGuard Oy (Finland), Diebold Nixdorf (US), RDM Corporation (Canada), Giesecke and Devrient GmbH (Germany), NCR Corporation (US), Sampi Secure Oy (Finland), Wincor Nixdorf (Germany), Nautilus Hyosung Corporation (South Korea), Bally Technologies (US), Diebold (US), Tidel Engineering LP (US), Glory Global Solutions (UK), and CPI Card Group Inc. (US).