Rising Cyber Threat Landscape

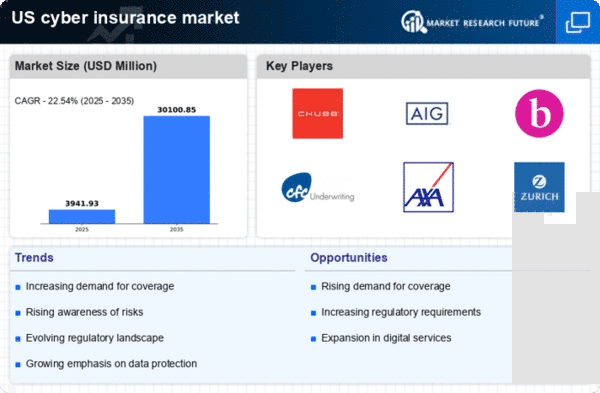

The escalating frequency and sophistication of cyber threats significantly influence the cyber insurance market. In recent years, the number of reported data breaches has surged, with estimates indicating that over 1,000 incidents occur daily in the US. This alarming trend compels organizations to seek comprehensive insurance solutions to mitigate potential financial losses. The cyber insurance market is responding to this demand by offering policies that cover a wide range of cyber risks, including ransomware attacks and data breaches. As businesses increasingly recognize the importance of safeguarding their digital assets, the market is projected to grow at a compound annual growth rate (CAGR) of approximately 20% over the next five years. This growth reflects a heightened awareness of cyber vulnerabilities and the necessity for robust insurance coverage.

Growing Awareness of Cyber Risks

As organizations increasingly recognize the potential financial repercussions of cyber incidents, awareness surrounding cyber risks is on the rise. This heightened consciousness is driving demand for cyber insurance products, as businesses seek to protect themselves from the financial fallout of data breaches and cyberattacks. The cyber insurance market is adapting to this shift by offering more comprehensive coverage options that address the specific needs of various sectors. Recent surveys indicate that approximately 70% of companies now consider cyber insurance a critical component of their risk management strategy. This growing awareness not only fuels market expansion but also encourages insurers to innovate and enhance their offerings, ensuring that businesses have access to the necessary protection against evolving cyber threats.

Increased Regulatory Requirements

The evolving regulatory landscape in the US plays a pivotal role in shaping the cyber insurance market. With the introduction of stringent data protection laws, such as the California Consumer Privacy Act (CCPA) and various state-level regulations, organizations are compelled to adopt comprehensive risk management strategies. These regulations often mandate that businesses maintain adequate insurance coverage to protect against potential data breaches and cyber incidents. Consequently, the cyber insurance market is witnessing a surge in demand as companies strive to comply with these legal requirements. It is estimated that nearly 60% of businesses are now prioritizing cyber insurance as part of their compliance strategy. This trend not only enhances the market's growth prospects but also encourages insurers to develop tailored policies that align with regulatory standards.

Technological Advancements in Cybersecurity

The rapid advancement of cybersecurity technologies significantly impacts the cyber insurance market. As organizations invest in cutting-edge security measures, such as artificial intelligence and machine learning, the landscape of cyber risk is evolving. Insurers are increasingly incorporating these technological advancements into their underwriting processes, allowing for more accurate risk assessments and tailored policy offerings. The cyber insurance market is likely to benefit from this trend, as businesses that implement robust cybersecurity measures may qualify for lower premiums. Furthermore, the integration of advanced technologies enables insurers to better understand and predict potential risks, fostering a more dynamic and responsive insurance environment. This synergy between technology and insurance is expected to drive market growth, as organizations seek to align their cybersecurity investments with appropriate insurance coverage.

Expansion of Digital Transformation Initiatives

The ongoing digital transformation across various industries is a significant driver of the cyber insurance market. As businesses increasingly adopt digital technologies, they expose themselves to new cyber risks that necessitate comprehensive insurance solutions. The cyber insurance market is witnessing a surge in demand as organizations recognize the need to protect their digital assets and customer data. Recent studies suggest that nearly 80% of companies undergoing digital transformation initiatives are considering cyber insurance as a vital component of their risk management strategy. This trend not only highlights the growing importance of cyber insurance but also indicates a shift in how organizations perceive and address cyber risks. As digital transformation continues to reshape the business landscape, the cyber insurance market is poised for substantial growth.