Expansion of Digital Economy

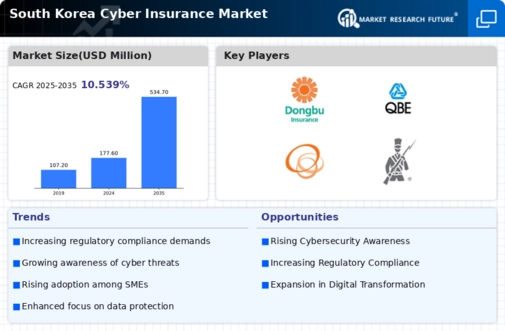

the market is experiencing growth due to the rapid expansion of the digital economy.. As more businesses transition to online platforms, the potential for cyber threats increases, necessitating comprehensive insurance coverage. In 2025, it is projected that the digital economy will account for over 20% of South Korea's GDP, highlighting the critical need for risk management solutions. This expansion is prompting organizations to invest in cyber insurance policies that protect against potential financial losses from cyber incidents. Furthermore, the increasing reliance on e-commerce and digital transactions is likely to drive demand for tailored insurance products that address specific risks associated with online operations. As the digital landscape evolves, the cyber insurance market is expected to grow in tandem with the digital economy, reflecting the interconnected nature of these sectors.

Increased Regulatory Scrutiny

the market is influenced by heightened regulatory scrutiny surrounding data protection and cybersecurity.. The government has implemented stringent regulations to safeguard personal information, compelling organizations to adopt comprehensive risk management practices. In 2025, compliance with these regulations is projected to be a key driver for the market, as companies seek insurance solutions that align with legal requirements. The Personal Information Protection Act (PIPA) mandates strict data handling protocols, and non-compliance can result in substantial fines. As businesses navigate these regulatory landscapes, the demand for cyber insurance products that offer coverage against potential legal liabilities is likely to increase. This trend suggests that organizations are not only focusing on compliance but also on securing their operations against potential breaches, thereby driving growth in the cyber insurance market.

Rising Cyber Threat Landscape

the market is experiencing growth due to an increasingly complex cyber threat landscape.. With cyberattacks becoming more sophisticated, businesses are recognizing the necessity of protecting their assets. In 2025, it is estimated that cybercrime costs could reach $10 trillion globally, prompting South Korean companies to seek insurance solutions. The rise in ransomware attacks and data breaches has led to a heightened awareness of the need for coverage. As organizations face potential financial losses and reputational damage, the demand for cyber insurance products is likely to surge. This trend indicates a shift in corporate risk management strategies, as firms prioritize safeguarding their digital infrastructure. Consequently, the cyber insurance market is expected to expand as businesses invest in policies that mitigate risks associated with cyber threats.

Growing Awareness of Cyber Risks

the market is benefiting from a growing awareness of cyber risks among businesses and consumers.. As digital transformation accelerates, organizations are increasingly recognizing the vulnerabilities associated with online operations. In 2025, surveys indicate that approximately 70% of South Korean companies acknowledge the importance of cyber insurance as a risk management tool. This awareness is fostering a proactive approach to cybersecurity, with businesses seeking tailored insurance solutions to address specific threats. The rise in publicized data breaches and cyber incidents has further amplified this awareness, leading to a shift in corporate attitudes towards risk. Consequently, the cyber insurance market is likely to see an influx of new clients as organizations prioritize risk mitigation strategies and invest in comprehensive insurance coverage.

Technological Advancements in Cybersecurity

the market is being shaped by rapid technological advancements in cybersecurity solutions.. As businesses adopt innovative technologies to protect their digital assets, the demand for cyber insurance products that complement these measures is increasing. In 2025, it is anticipated that the integration of artificial intelligence and machine learning in cybersecurity will enhance threat detection and response capabilities. This evolution in technology not only reduces the likelihood of cyber incidents but also influences the underwriting process for insurance providers. Insurers are likely to offer more favorable terms to organizations that implement robust cybersecurity measures, thereby driving growth in the cyber insurance market. This trend indicates a symbiotic relationship between technology and insurance, as advancements in cybersecurity create new opportunities for risk management.