Rising Cyber Threat Landscape

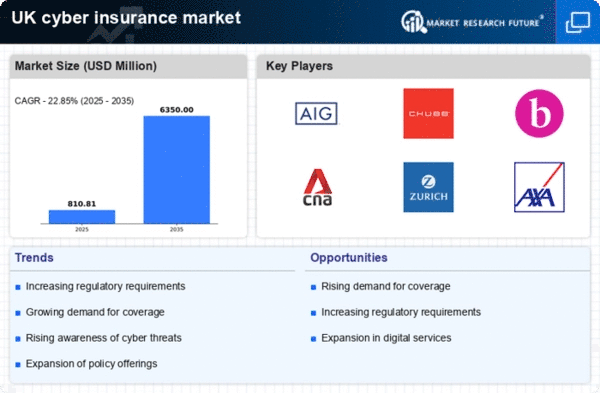

The cyber insurance market is experiencing growth due to the escalating threat landscape in the UK. With cyberattacks becoming increasingly sophisticated, businesses are recognizing the necessity of protecting their assets. In 2025, it is estimated that cybercrime will cost the UK economy over £10 billion annually. This alarming trend compels organizations to seek insurance solutions that can mitigate financial losses resulting from data breaches and ransomware attacks. The heightened awareness of potential risks drives demand for comprehensive coverage, prompting insurers to develop tailored policies that address specific vulnerabilities. As a result, the cyber insurance market is likely to expand, with more businesses investing in protective measures to safeguard their operations against cyber threats.

Increased Regulatory Compliance

The cyber insurance market is significantly influenced by the evolving regulatory landscape in the UK. With the introduction of stringent data protection laws, such as the UK General Data Protection Regulation (GDPR), organizations are compelled to adopt robust cybersecurity measures. Non-compliance can lead to hefty fines, which may reach up to £17 million or 4% of annual global turnover, whichever is higher. Consequently, businesses are increasingly turning to cyber insurance as a means to ensure compliance and protect against potential liabilities. This trend indicates a growing recognition of the importance of cyber insurance in managing regulatory risks, thereby driving market growth. Insurers are responding by offering policies that align with regulatory requirements, further enhancing the appeal of cyber insurance solutions.

Rising Awareness of Cyber Risks

The growing awareness of cyber risks among businesses and consumers is a significant driver for the cyber insurance market. As high-profile data breaches and cyberattacks dominate headlines, organizations are becoming more cognizant of their vulnerabilities. In 2025, surveys indicate that approximately 60% of UK businesses will consider cyber insurance as a critical component of their risk management strategy. This shift in perception is likely to lead to increased demand for cyber insurance products, as companies seek to protect themselves from potential financial repercussions. Insurers are responding by enhancing their offerings and providing educational resources to help businesses understand the importance of coverage. This heightened awareness is expected to propel the cyber insurance market forward, as more organizations recognize the necessity of safeguarding their digital assets.

Growing Digital Transformation Initiatives

The ongoing digital transformation across various sectors in the UK is a key driver for the cyber insurance market. As organizations increasingly adopt cloud computing, IoT devices, and digital platforms, they expose themselves to new cyber risks. In 2025, it is projected that over 70% of UK businesses will have migrated to cloud-based services, creating a pressing need for adequate cyber insurance coverage. This shift not only increases the attack surface for cybercriminals but also necessitates a reevaluation of existing insurance policies. The cyber insurance market is likely to benefit from this trend, as businesses seek to protect their digital assets and ensure business continuity in the face of potential cyber incidents. Insurers are thus incentivized to innovate and provide tailored solutions that cater to the unique challenges posed by digital transformation.

Technological Advancements in Risk Assessment

Technological advancements in risk assessment tools are playing a pivotal role in shaping the cyber insurance market. The integration of artificial intelligence and machine learning enables insurers to better evaluate risks associated with cyber threats. In 2025, it is anticipated that over 50% of cyber insurance providers in the UK will utilize advanced analytics to assess client vulnerabilities. This capability allows for more accurate pricing of policies and tailored coverage options, which can enhance the overall value proposition for businesses. As insurers leverage technology to refine their underwriting processes, the cyber insurance market is likely to see increased competition and innovation. This trend suggests that businesses will benefit from more customized insurance solutions that align with their specific risk profiles.