Market Trends

Key Emerging Trends in the US Color Cosmetics Market

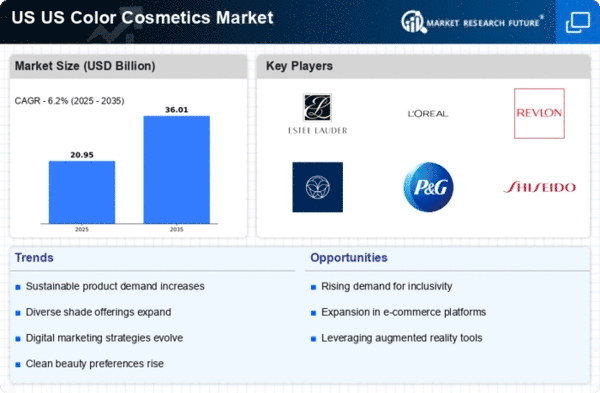

The US Color Cosmetics Market is undergoing dynamic changes, shaped by various trends that reflect the evolving beauty and personal care industry. One notable trend is the growing demand for clean and sustainable beauty products. With increasing consumer awareness of ingredient transparency and environmental impact, there is a rising preference for color cosmetics formulated with natural and eco-friendly ingredients. This trend has led to the emergence of clean beauty brands and the reformulation of existing products to meet the demand for sustainable and cruelty-free cosmetics, highlighting the industry's commitment to responsible and ethical practices.

Moreover, inclusivity and diversity have become central themes in the US Color Cosmetics Market. Consumers are seeking beauty products that cater to a wide range of skin tones and undertones, prompting brands to expand their shade ranges and offer more inclusive color options. This trend is driven by a recognition of the diverse beauty standards and preferences among consumers, leading to a more inclusive representation in marketing campaigns and product offerings. The industry's shift towards inclusivity reflects a broader cultural movement towards celebrating diversity in beauty.

Technological advancements are playing a significant role in shaping the market trends of color cosmetics in the US. The rise of augmented reality (AR) and virtual try-on technologies has transformed the way consumers experience and purchase cosmetics. Virtual platforms allow consumers to virtually try on different makeup products, helping them make more informed purchasing decisions. This trend not only enhances the online shopping experience but also addresses the challenges of purchasing color cosmetics without physical testing, especially in the era of increased e-commerce.

E-commerce is a driving force influencing the distribution channels of color cosmetics in the US. Online platforms have become primary channels for consumers to discover and purchase beauty products. The convenience of online shopping, coupled with the availability of detailed product information and customer reviews, has reshaped the retail landscape for color cosmetics. Brands are investing in user-friendly online platforms, digital marketing, and e-commerce strategies to engage with consumers and capitalize on the growing trend of online beauty retail.

The rise of beauty influencers and social media has a significant impact on the US Color Cosmetics Market. Beauty influencers on platforms like Instagram, YouTube, and TikTok have become influential voices in shaping beauty trends and product preferences. Consumers often turn to these influencers for product recommendations, makeup tutorials, and reviews, influencing their purchasing decisions. Brands are leveraging social media platforms for marketing and engaging with consumers, creating a more interactive and community-driven approach to beauty.

Customization is another prevailing trend in the US Color Cosmetics Market. Consumers are increasingly seeking personalized beauty experiences, leading to the rise of customizable makeup products and services. Brands are offering options for consumers to create bespoke beauty products, from choosing specific shades to customizing product formulations based on individual preferences. This trend aligns with the broader consumer demand for unique and personalized beauty solutions, reflecting a departure from one-size-fits-all approaches.

Furthermore, sustainability is a driving force influencing packaging trends in the color cosmetics industry. Brands are exploring eco-friendly and recyclable packaging options to minimize environmental impact. This trend is in response to consumer concerns about excessive packaging waste and the environmental footprint of the beauty industry. As sustainability becomes a focal point, brands are innovating in packaging design and materials to meet the demand for more environmentally conscious choices.

Leave a Comment