Us Color Cosmetics Size

US Color Cosmetics Market Growth Projections and Opportunities

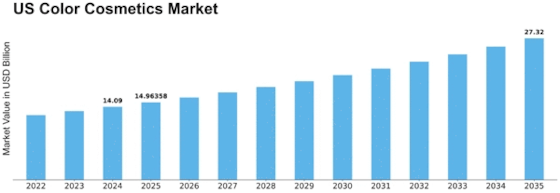

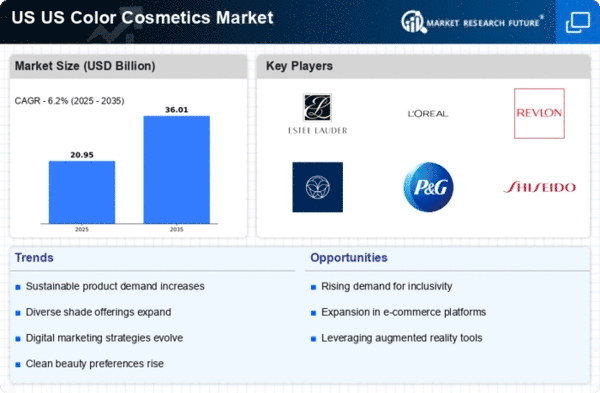

The US color cosmetics market size was valued at USD 12.5 Billion in 2022. The color cosmetics industry is projected to grow from USD 13.27 Billion in 2023 to USD 21.47 Billion by 2032, exhibiting a compound annual growth rate (CAGR) of 6.20%

The US Color Cosmetics Market is influenced by a diverse set of market factors that contribute to its growth and vibrancy. One of the primary drivers is the changing consumer preferences and beauty trends. As consumer awareness of beauty products expands, there is an increasing demand for a variety of colors, textures, and formulations. The dynamic nature of beauty trends, fueled by social media and influencers, drives innovation in color cosmetics, prompting brands to continuously introduce new products and shades to cater to the evolving tastes of consumers.

Moreover, the influence of e-commerce and digital channels significantly impacts the US Color Cosmetics Market. The rise of online beauty platforms and the accessibility of beauty products through e-commerce have transformed the way consumers discover and purchase cosmetics. The convenience of online shopping, coupled with the ability to access a wide range of products and reviews, has propelled the growth of the color cosmetics market. Beauty brands are adapting their strategies to leverage digital platforms, emphasizing e-commerce as a crucial channel for reaching consumers.

Innovation and product differentiation play a pivotal role in shaping the market. With a highly competitive landscape, cosmetic brands are compelled to introduce unique formulations, packaging, and marketing strategies to stand out in the market. The introduction of new technologies, such as long-lasting and cruelty-free formulations, reflects the industry's commitment to meeting consumer demands for high-quality, ethically produced products. Innovation in color cosmetics extends beyond shades and includes features like sustainable packaging and clean beauty formulations.

The influence of social and cultural factors is also noteworthy. The makeup industry is increasingly recognizing and embracing diversity in beauty. Brands are expanding their shade ranges to be more inclusive, reflecting a broader spectrum of skin tones. This inclusivity is not only a response to changing societal norms but also a strategic move to capture a diverse consumer base. The acknowledgment of diverse beauty standards contributes to the market's growth by broadening the appeal of color cosmetics to a wider audience.

Government regulations related to cosmetics and beauty products are crucial market factors. Regulatory standards from organizations like the Food and Drug Administration (FDA) influence the formulation, labeling, and safety of color cosmetics. Compliance with these regulations is essential for brand credibility and consumer trust. Additionally, evolving regulations around clean beauty and ingredient transparency impact product development and marketing strategies in the color cosmetics industry.

The impact of the wellness trend is notable in the color cosmetics market. Consumers are increasingly seeking products that not only enhance their appearance but also contribute to overall skin health. The integration of skincare benefits into color cosmetics, such as products with SPF protection or anti-aging properties, reflects this wellness-driven approach. Beauty brands are aligning with the consumer desire for multi-functional products that provide both aesthetic and skincare benefits.

The competitive landscape and brand collaborations contribute to market dynamics. Influencer collaborations, celebrity partnerships, and limited-edition releases create excitement and drive consumer engagement. These collaborations not only bring new and exclusive products to the market but also serve as effective marketing strategies, leveraging the popularity and influence of personalities to boost brand visibility and sales.

Leave a Comment