Rising Prevalence of Genetic Disorders

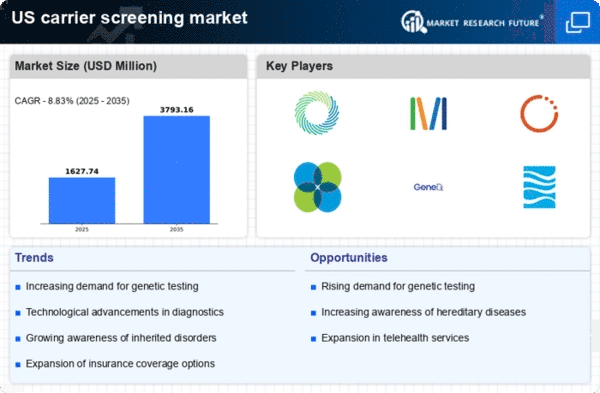

The increasing prevalence of genetic disorders in the US population appears to be a significant driver for the carrier screening market. As more individuals are diagnosed with conditions such as cystic fibrosis and sickle cell disease, the demand for carrier screening tests is likely to rise. According to the CDC, approximately 1 in 25 individuals of Ashkenazi Jewish descent is a carrier for Tay-Sachs disease, highlighting the need for targeted screening. This growing awareness of genetic risks may lead to a greater emphasis on preventive healthcare measures, thereby expanding the carrier screening market. Furthermore, the integration of carrier screening into routine prenatal care could potentially enhance early detection and management of genetic conditions, fostering a more proactive approach to health in the US.

Legislative Support for Genetic Testing

Legislative initiatives aimed at supporting genetic testing and screening are likely to influence the carrier screening market positively. Recent policies in the US have focused on improving access to genetic testing services, particularly for underserved populations. For instance, some states have enacted laws mandating insurance coverage for carrier screening, which may alleviate financial barriers for patients. This legislative support could encourage more individuals to pursue carrier screening, thereby expanding the market. Additionally, public health campaigns promoting the importance of genetic testing may further raise awareness and acceptance among the general population. As these initiatives gain traction, the carrier screening market may experience increased growth and integration into standard healthcare practices.

Growing Acceptance of Genetic Counseling

The rising acceptance of genetic counseling services is emerging as a key driver for the carrier screening market. As more individuals seek guidance on genetic testing options, the role of genetic counselors becomes increasingly vital. These professionals help patients navigate the complexities of genetic information, ensuring that they understand the implications of carrier screening results. The National Society of Genetic Counselors reports a steady increase in the number of certified genetic counselors in the US, which may enhance the accessibility of these services. This trend suggests that as patients become more informed about their genetic health, the demand for carrier screening is likely to grow. Furthermore, the collaboration between healthcare providers and genetic counselors may facilitate a more comprehensive approach to patient care.

Increased Focus on Preventive Healthcare

The growing emphasis on preventive healthcare in the US is likely to bolster the carrier screening market. As healthcare systems shift towards value-based care, there is a heightened focus on early detection and intervention strategies. Carrier screening plays a crucial role in this paradigm by enabling individuals to understand their genetic risks and make informed reproductive choices. The US Preventive Services Task Force has recommended that all couples planning a pregnancy consider carrier screening for certain genetic conditions, which may further encourage uptake. This proactive approach to health management could lead to an increase in the number of individuals seeking carrier screening, thereby expanding the market. The integration of carrier screening into routine healthcare practices may also enhance patient engagement and awareness.

Advancements in Genetic Testing Technologies

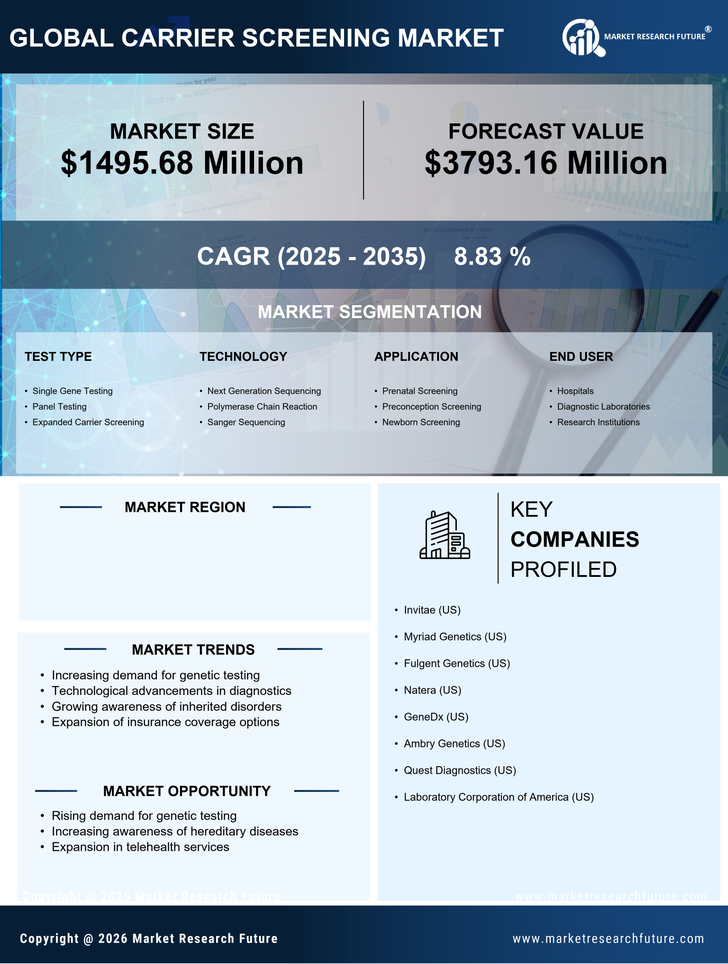

Technological innovations in genetic testing methodologies are transforming the landscape of the carrier screening market. The advent of next-generation sequencing (NGS) has significantly improved the accuracy and efficiency of genetic tests, allowing for the simultaneous analysis of multiple genes. This advancement not only reduces the time required for testing but also lowers costs, making carrier screening more accessible to a broader population. As the price of genetic testing continues to decrease, it is projected that the market will experience substantial growth. The ability to provide comprehensive carrier screening panels that can identify a wide array of genetic conditions may further drive demand, as healthcare providers and patients increasingly recognize the value of early genetic insights.