Increasing Demand for Energy

The Crude Oil Carrier Market is experiencing a surge in demand for energy, driven by the growing global population and industrialization. As economies expand, the need for crude oil as a primary energy source remains paramount. According to recent data, the demand for crude oil is projected to reach approximately 100 million barrels per day by 2025. This increase necessitates a robust fleet of crude oil carriers to transport the rising volumes efficiently. Furthermore, emerging markets are likely to contribute significantly to this demand, as they continue to develop their energy infrastructures. Consequently, the Crude Oil Carrier Market is poised for growth, as shipping companies invest in new vessels to meet the anticipated needs of the energy sector.

Investment in Fleet Modernization

Investment in fleet modernization is a pivotal driver for the Crude Oil Carrier Market. Shipping companies are increasingly focusing on upgrading their fleets to enhance efficiency and reduce operational costs. The introduction of advanced technologies, such as digital navigation systems and eco-friendly engines, is transforming the industry. Reports indicate that the global fleet of crude oil carriers is expected to grow by approximately 3% annually over the next five years. This modernization not only improves the environmental footprint of the vessels but also aligns with regulatory requirements aimed at reducing emissions. As a result, the Crude Oil Carrier Market is likely to witness a shift towards more technologically advanced and environmentally compliant vessels.

Geopolitical Factors and Supply Chain Dynamics

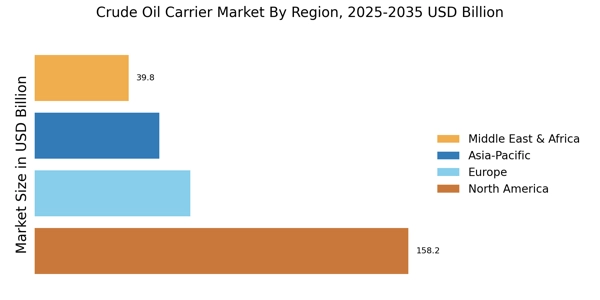

Geopolitical tensions and supply chain dynamics play a crucial role in shaping the Crude Oil Carrier Market. Events such as conflicts in oil-rich regions can disrupt supply chains, leading to fluctuations in oil prices and shipping routes. For instance, tensions in the Middle East have historically impacted oil supply, necessitating the need for reliable crude oil carriers to navigate these challenges. Additionally, the strategic importance of certain maritime routes, such as the Strait of Hormuz, underscores the significance of the Crude Oil Carrier Market in ensuring energy security. As nations seek to stabilize their energy supplies, the demand for efficient and secure transportation solutions is likely to increase, further driving growth in this sector.

Emerging Markets and Infrastructure Development

Emerging markets are becoming increasingly influential in the Crude Oil Carrier Market, driven by rapid infrastructure development and urbanization. Countries in Asia and Africa are investing heavily in their energy sectors, leading to a heightened demand for crude oil transportation. For instance, the construction of new refineries and ports in these regions is expected to facilitate increased crude oil imports. This trend is supported by projections indicating that oil consumption in these markets could rise by over 5% annually. Consequently, the Crude Oil Carrier Market is likely to benefit from the expansion of shipping routes and the need for additional carriers to meet the demands of these burgeoning economies.

Technological Innovations in Shipping Operations

Technological innovations are reshaping the operational landscape of the Crude Oil Carrier Market. The integration of automation, artificial intelligence, and data analytics is enhancing operational efficiency and safety in shipping operations. For example, predictive maintenance technologies are being adopted to minimize downtime and optimize vessel performance. Furthermore, advancements in cargo tracking systems are improving transparency and accountability in the transportation of crude oil. As these technologies become more prevalent, they are expected to drive down operational costs and improve service delivery. The Crude Oil Carrier Market stands to gain from these innovations, as they not only enhance competitiveness but also align with the industry's push towards greater efficiency and sustainability.