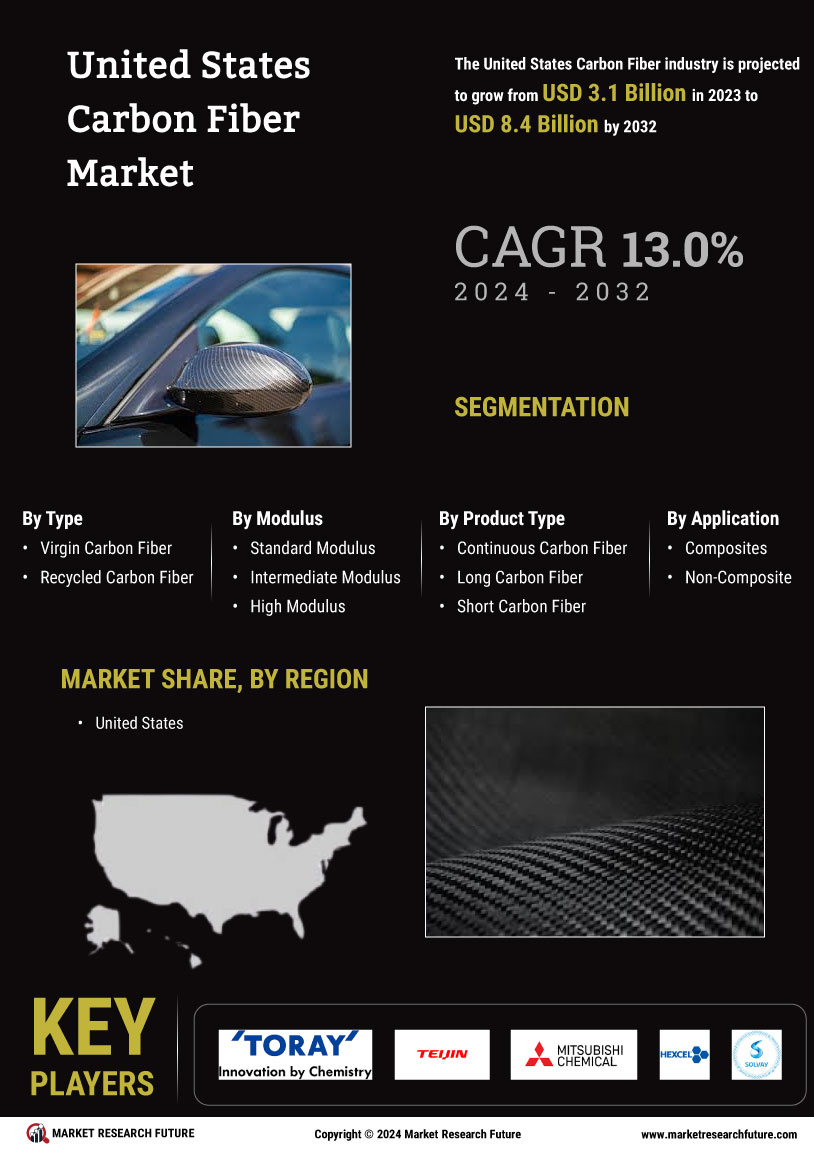

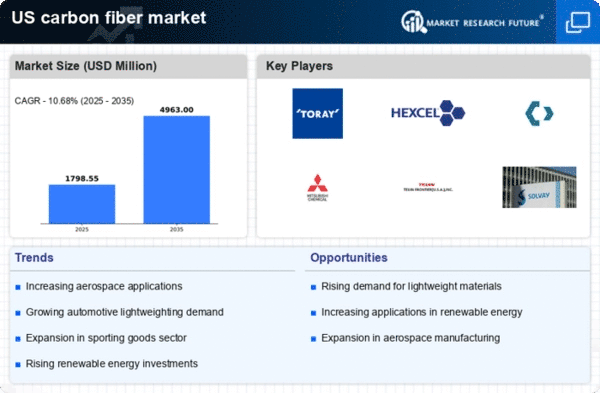

Growth in Automotive Applications

The United States Carbon Fiber Market is witnessing a significant expansion in automotive applications. With the automotive sector increasingly focusing on lightweight materials to improve fuel efficiency and reduce emissions, carbon fiber is becoming a preferred choice. In 2025, it is estimated that the automotive industry will represent around 25% of the carbon fiber market share in the United States. This growth is fueled by the rising demand for electric vehicles, which require lightweight components to enhance battery efficiency. As manufacturers invest in research and development to integrate carbon fiber into vehicle designs, the market is poised for substantial growth in the coming years.

Increasing Demand in Aerospace Sector

The United States Carbon Fiber Market is experiencing a notable surge in demand, particularly from the aerospace sector. Carbon fiber's lightweight and high-strength properties make it an ideal material for aircraft components, contributing to fuel efficiency and performance. In 2025, the aerospace industry is projected to account for approximately 30% of the total carbon fiber consumption in the United States. This trend is driven by the ongoing development of advanced aircraft and the need for materials that enhance performance while reducing weight. As manufacturers seek to comply with stringent environmental regulations, the adoption of carbon fiber composites is likely to increase, further solidifying its role in the aerospace sector.

Rising Investment in Renewable Energy

The United States Carbon Fiber Market is experiencing a boost from rising investments in renewable energy projects. Carbon fiber is increasingly utilized in wind turbine blades and other renewable energy applications due to its lightweight and durable characteristics. In 2025, the renewable energy sector is expected to account for a growing share of carbon fiber consumption, driven by the need for efficient and sustainable energy solutions. As the United States continues to transition towards renewable energy sources, the demand for carbon fiber in this sector is likely to increase, presenting new opportunities for manufacturers.

Advancements in Manufacturing Technologies

The United States Carbon Fiber Market is benefiting from advancements in manufacturing technologies that enhance production efficiency and reduce costs. Innovations such as automated fiber placement and 3D printing are streamlining the production process, making carbon fiber more accessible to various industries. These technologies not only improve the quality of carbon fiber products but also enable manufacturers to meet the increasing demand from sectors like aerospace and automotive. As production capabilities expand, the market is likely to see a rise in the adoption of carbon fiber composites, further driving growth in the United States.

Emerging Applications in Sports and Recreation

The United States Carbon Fiber Market is expanding into emerging applications within the sports and recreation sector. Carbon fiber's unique properties make it an attractive material for high-performance sporting goods, including bicycles, golf clubs, and fishing rods. As consumers increasingly seek lightweight and durable products, the demand for carbon fiber in this sector is projected to grow. In 2025, it is anticipated that the sports and recreation industry will contribute a notable share to the overall carbon fiber market. This trend reflects a broader shift towards performance-oriented products, further driving the adoption of carbon fiber across various applications.