Expansion of Biobanking Initiatives

The expansion of biobanking initiatives is a critical driver for the biopreservation market. Biobanks play a vital role in collecting, storing, and managing biological samples for research and clinical purposes. With the number of biobanks in the US increasing significantly, the demand for effective biopreservation solutions is expected to rise correspondingly. It is estimated that the biobanking sector will require an investment of over $500 million in biopreservation technologies by 2027. This growth is fueled by the need for high-quality samples in various research fields, including genomics, oncology, and infectious diseases. As biobanks continue to proliferate, the biopreservation market is likely to experience substantial growth.

Growing Focus on Personalized Medicine

The biopreservation market is poised for growth due to the increasing focus on personalized medicine. As healthcare shifts towards tailored treatment approaches, the demand for biopreservation solutions that can effectively store and manage biological samples is on the rise. The market for personalized medicine is projected to reach $2 trillion by 2030, indicating a substantial opportunity for biopreservation technologies. This trend is driven by advancements in genomics and proteomics, which require precise preservation methods to maintain sample quality. Consequently, the biopreservation market is likely to see heightened investment and innovation as stakeholders seek to support the evolving landscape of personalized healthcare.

Increased Awareness of Food Safety Standards

The biopreservation market is also being driven by increased awareness of food safety standards among consumers and regulatory bodies. As foodborne illnesses remain a significant public health concern, there is a growing emphasis on implementing effective preservation methods to ensure food safety. The food industry is projected to invest approximately $1 billion in biopreservation technologies by 2025, reflecting a commitment to enhancing food quality and safety. This trend is likely to lead to the adoption of biopreservation techniques that utilize natural preservatives and microbial agents, thereby promoting the growth of the biopreservation market. As consumers demand safer food products, the market is expected to respond with innovative preservation solutions.

Surge in Research and Development Activities

The biopreservation market is significantly influenced by the surge in research and development (R&D) activities across various sectors, particularly in biotechnology and pharmaceuticals. With R&D expenditures in the US reaching approximately $200 billion annually, there is a growing emphasis on developing advanced preservation methods for biological samples. This trend is expected to drive the demand for biopreservation solutions, as researchers require reliable methods to maintain the integrity of samples over extended periods. Furthermore, the increasing number of clinical trials and biobanking initiatives is likely to further propel the biopreservation market, as these activities necessitate stringent preservation protocols to ensure sample viability.

Rising Adoption of Biopreservation in Healthcare

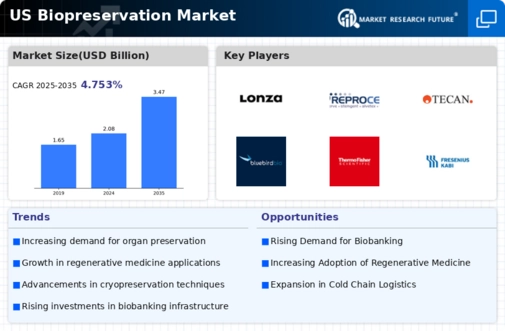

The biopreservation market is experiencing a notable increase in adoption within the healthcare sector. This trend is driven by the growing need for effective preservation methods for biological materials, such as tissues and organs. The healthcare industry is projected to invest approximately $1.5 billion in biopreservation technologies by 2026, reflecting a compound annual growth rate (CAGR) of around 10%. This investment is largely influenced by the rising prevalence of chronic diseases and the need for organ transplants, which necessitate reliable preservation techniques. As healthcare providers seek to enhance patient outcomes, the biopreservation market is likely to benefit from this heightened focus on innovative preservation solutions.

.png)