Rising Diabetes Prevalence

The increasing incidence of diabetes in the US is a primary driver for the artificial pancreas-device-system market. According to the Centers for Disease Control and Prevention (CDC), approximately 34.2 million Americans, or 10.5% of the population, have diabetes. This growing patient population necessitates advanced management solutions, such as artificial pancreas systems, which can automate insulin delivery and improve glycemic control. The demand for these devices is likely to rise as healthcare providers seek effective ways to manage diabetes complications. Furthermore, the economic burden of diabetes, estimated at $327 billion annually, underscores the need for innovative solutions that can enhance patient outcomes and reduce healthcare costs. As awareness of diabetes management options increases, the artificial pancreas-device-system market is expected to expand significantly.

Technological Advancements in Device Design

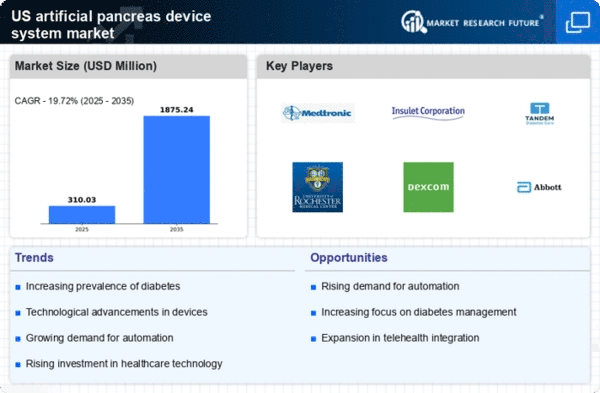

Innovations in technology are propelling the artificial pancreas-device-system market forward. Recent advancements in sensor technology, algorithms, and connectivity have enhanced the functionality and reliability of these devices. For instance, the integration of continuous glucose monitoring (CGM) systems with insulin delivery devices has improved real-time data accuracy, allowing for better glycemic control. The market is witnessing a shift towards more user-friendly designs, which may include smartphone applications for monitoring and control. As these technologies evolve, they are likely to attract more users, thereby expanding the market. The artificial pancreas-device-system market is projected to grow at a compound annual growth rate (CAGR) of around 20% over the next five years, driven by these technological innovations.

Regulatory Approvals and Market Accessibility

Regulatory approvals play a crucial role in shaping the artificial pancreas-device-system market. The US Food and Drug Administration (FDA) has streamlined the approval process for innovative diabetes management devices, which encourages manufacturers to bring new products to market. This regulatory support is essential for fostering competition and innovation within the industry. As more devices receive FDA clearance, patients gain access to a wider range of options, which may enhance their treatment experience. The artificial pancreas-device-system market is likely to see increased growth as regulatory pathways become more efficient, allowing for quicker adoption of new technologies that can improve diabetes management.

Growing Awareness and Education on Diabetes Care

The increasing awareness and education surrounding diabetes care are pivotal for the artificial pancreas-device-system market. Healthcare providers and organizations are actively promoting the benefits of advanced diabetes management technologies. Educational campaigns aimed at patients emphasize the importance of effective glycemic control and the role of artificial pancreas systems in achieving this goal. As patients become more informed about their treatment options, the demand for these devices is expected to rise. Furthermore, the artificial pancreas-device-system market may benefit from collaborations between healthcare providers and technology companies to enhance patient education and support, ultimately leading to improved health outcomes.

Increased Investment in Diabetes Management Solutions

Investment in diabetes management solutions is a significant driver for the artificial pancreas-device-system market. Both public and private sectors are channeling funds into research and development to create more effective diabetes management tools. The National Institutes of Health (NIH) has allocated substantial resources towards diabetes research, which includes the development of artificial pancreas systems. Additionally, venture capital investments in health technology startups focusing on diabetes management have surged, indicating a strong belief in the potential of these devices. This influx of capital is likely to accelerate innovation and bring new products to market, further stimulating growth in the artificial pancreas-device-system market.