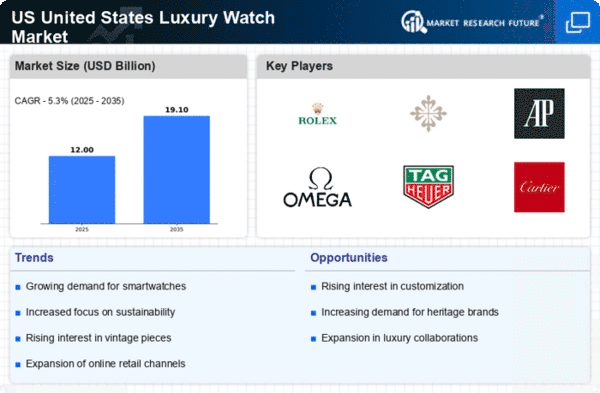

The Luxury Watch Market is currently characterized by a dynamic competitive landscape, driven by factors such as consumer demand for exclusivity, craftsmanship, and technological innovation. Key players like Rolex (US), Omega (CH), and Patek Philippe (CH) are at the forefront, each adopting distinct strategies to enhance their market positioning. Rolex (US) continues to emphasize its heritage and brand prestige, focusing on limited editions and bespoke services to attract affluent consumers. Meanwhile, Omega (CH) is leveraging its association with sports and space exploration to reinforce its brand narrative, while Patek Philippe (CH) is concentrating on maintaining its artisanal craftsmanship and exclusivity, which resonates deeply with collectors and connoisseurs. Collectively, these strategies contribute to a competitive environment that prioritizes brand loyalty and high-value offerings.

In terms of business tactics, companies are increasingly localizing manufacturing and optimizing supply chains to enhance efficiency and responsiveness to market demands. The market structure appears moderately fragmented, with a mix of established luxury brands and emerging players. The influence of key players is substantial, as they set trends and standards that smaller brands often follow, thereby shaping the overall market dynamics.

In December 2025, Rolex (US) announced the opening of a new manufacturing facility in the U.S., aimed at increasing production capacity and reducing lead times for its popular models. This strategic move is likely to enhance Rolex's ability to meet growing demand while reinforcing its commitment to quality and craftsmanship. The facility is expected to create jobs and stimulate local economies, further embedding the brand within the U.S. market.

In November 2025, Omega (CH) launched a new line of eco-friendly watches, utilizing sustainable materials and innovative production techniques. This initiative not only aligns with the growing consumer preference for sustainability but also positions Omega as a forward-thinking brand in the luxury segment. The introduction of these watches may attract environmentally conscious consumers, thereby expanding Omega's market reach.

In October 2025, Patek Philippe (CH) unveiled a partnership with a renowned luxury automobile manufacturer to create a limited-edition watch that embodies both brands' commitment to precision and craftsmanship. This collaboration is significant as it merges two luxury sectors, potentially attracting enthusiasts from both markets and enhancing brand visibility. Such partnerships may become a trend as brands seek to differentiate themselves in a crowded marketplace.

As of January 2026, current competitive trends in the Luxury Watch Market are increasingly defined by digitalization, sustainability, and the integration of AI technologies. Strategic alliances are becoming more prevalent, as brands recognize the value of collaboration in enhancing innovation and market reach. Looking ahead, competitive differentiation is likely to evolve from traditional price-based competition to a focus on innovation, technological advancements, and supply chain reliability. This shift suggests that brands that can effectively leverage these trends will be better positioned to thrive in an ever-evolving market.