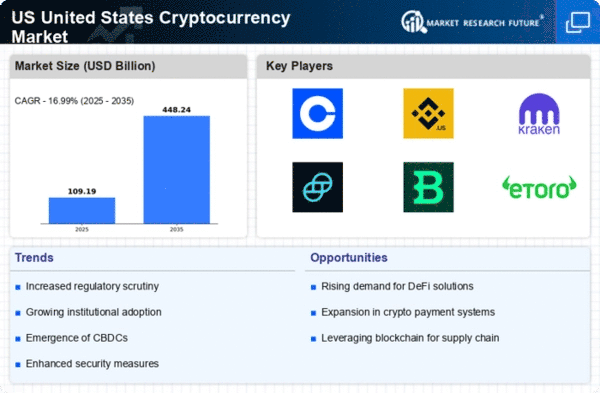

The Cryptocurrency Market in the United States is characterized by a rapidly evolving competitive landscape, driven by technological advancements, regulatory developments, and increasing consumer adoption. Major players such as Coinbase (US), Binance US (US), and Kraken (US) are at the forefront, each employing distinct strategies to solidify their market positions. Coinbase (US) focuses on user-friendly interfaces and educational resources, aiming to attract new investors, while Binance US (US) emphasizes a broad range of cryptocurrencies and trading options, appealing to more experienced traders. Kraken (US) has carved a niche by prioritizing security and compliance, which resonates with institutional investors. Collectively, these strategies contribute to a dynamic environment where innovation and customer-centric approaches are paramount.

The business tactics employed by these companies reflect a moderately fragmented market structure, where competition is fierce yet diverse. Localizing services and optimizing user experiences are common tactics, as companies strive to cater to regional preferences and regulatory requirements. The influence of key players is substantial, as their operational decisions often set industry standards and shape consumer expectations. This competitive structure fosters an environment where agility and responsiveness to market changes are critical for success.

In December 2025, Coinbase (US) announced a strategic partnership with a leading fintech firm to enhance its payment processing capabilities. This move is significant as it aims to streamline transactions for users, potentially increasing transaction volumes and user retention. By integrating advanced payment solutions, Coinbase (US) positions itself to capture a larger share of the market, particularly among users seeking seamless experiences.

In November 2025, Binance US (US) launched a new staking feature that allows users to earn rewards on their cryptocurrency holdings. This initiative is strategically important as it not only incentivizes users to hold their assets on the platform but also enhances customer loyalty. By diversifying its offerings, Binance US (US) strengthens its competitive edge in a market where user engagement is crucial.

In October 2025, Kraken (US) expanded its services to include a new suite of institutional-grade trading tools. This expansion is indicative of Kraken's commitment to attracting institutional investors, a segment that is increasingly seeking reliable and sophisticated trading platforms. By enhancing its service offerings, Kraken (US) is likely to bolster its market position and appeal to a broader audience.

As of January 2026, current trends in the Cryptocurrency Market are heavily influenced by digitalization, sustainability, and the integration of artificial intelligence (AI). Strategic alliances are becoming increasingly important, as companies collaborate to enhance technological capabilities and expand their service offerings. The competitive differentiation is expected to evolve, shifting from price-based competition to a focus on innovation, technology, and supply chain reliability. This transition suggests that companies that prioritize technological advancements and customer-centric solutions will likely emerge as leaders in the market.