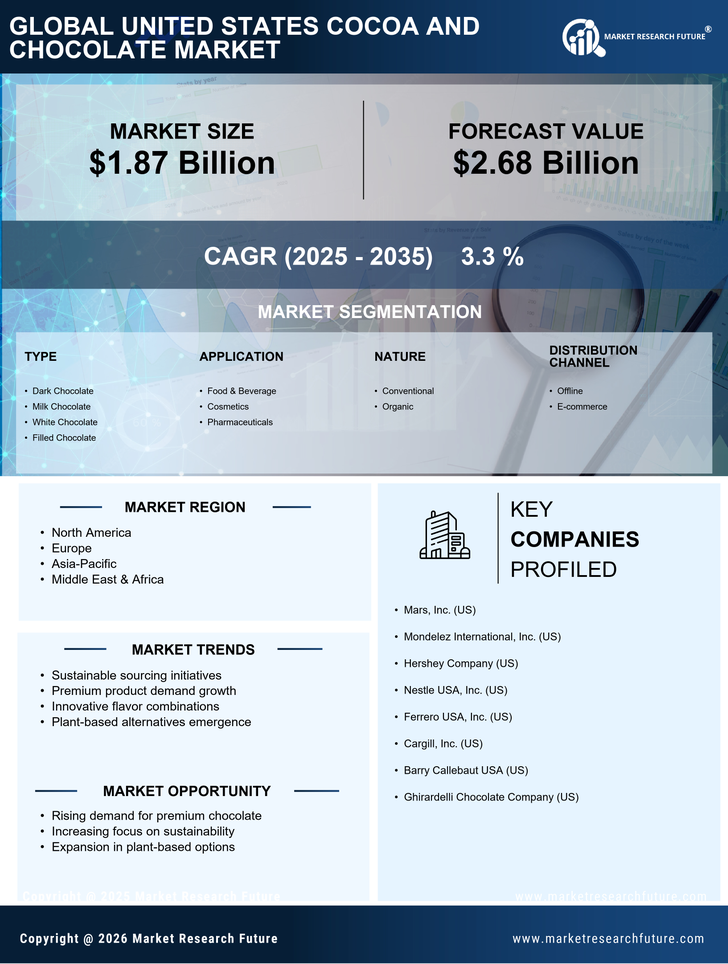

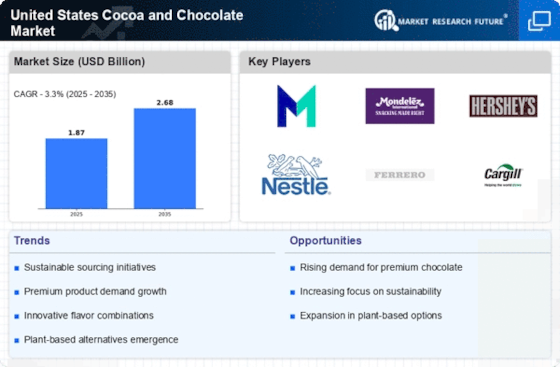

The competitive dynamics of the cocoa chocolate market in the United States are characterized by a blend of innovation, strategic partnerships, and a focus on sustainability. Major players such as Mars, Inc. (US), Mondelez International, Inc. (US), and Hershey Company (US) are actively shaping the landscape through various operational strategies. Mars, Inc. (US) emphasizes product innovation and sustainability, aiming to enhance its market share by introducing new flavors and eco-friendly packaging. Mondelez International, Inc. (US) focuses on expanding its digital presence and e-commerce capabilities, which appears to be a critical driver for growth in the current market. Hershey Company (US) is also investing in regional expansion and diversifying its product portfolio, particularly in the premium chocolate segment, which seems to be gaining traction among consumers seeking higher quality products.

The business tactics employed by these companies include localizing manufacturing and optimizing supply chains to enhance efficiency and reduce costs. The market structure appears moderately fragmented, with a few dominant players exerting considerable influence. This collective presence of key players fosters a competitive environment where innovation and consumer preferences dictate market trends.

In November 2025, Mars, Inc. (US) announced a partnership with a leading tech firm to develop AI-driven supply chain solutions aimed at improving operational efficiency. This strategic move is likely to enhance Mars's ability to respond to market demands swiftly, thereby solidifying its competitive edge. The integration of AI into supply chain management could potentially reduce costs and improve product availability, which is crucial in a market characterized by fluctuating consumer preferences.

In December 2025, Mondelez International, Inc. (US) launched a new line of organic chocolate products, responding to the growing consumer demand for healthier options. This initiative not only aligns with current health trends but also positions Mondelez as a leader in the organic segment of the market. The introduction of organic products may attract a new demographic of health-conscious consumers, thereby expanding the company's market reach.

In January 2026, Hershey Company (US) unveiled a sustainability initiative aimed at reducing its carbon footprint by 50% by 2030. This ambitious goal reflects a broader industry trend towards sustainability and may enhance Hershey's brand image among environmentally conscious consumers. By prioritizing sustainability, Hershey is likely to differentiate itself in a crowded market, appealing to consumers who value corporate responsibility.

As of January 2026, the cocoa chocolate market is witnessing trends such as digitalization, sustainability, and the integration of advanced technologies like AI. Strategic alliances among companies are increasingly shaping the competitive landscape, fostering innovation and collaboration. The shift from price-based competition to a focus on innovation, technology, and supply chain reliability is evident. Companies that can effectively leverage these trends are likely to thrive in the evolving market, positioning themselves for long-term success.